-

Ying Peng

Jinteng Technology

Design Director

Ying Peng

Jinteng Technology

Design Director

Ying Peng is the design director of Jinteng Technology. Jinteng Technology is a joint venture technology company established by CICC and Tencent, which is not only a "digital innovation" under CICC system but also helps to create a "private banking service" within Tencent ecology. She led the team to complete the experience building of a high-end wealth management platform from 0 to 1. She has worked for Tencent Financial Technology for 8 years, leading the experience building from 0 to 1 for many businesses such as QQ Pay, QQ Red Envelope, and Tencent Transit QR Code.

Design Concept: Empowering business through service design, build online and offline service-oriented high-end financial product experience, and create a leading wealth management platform that is user-centered and buyer-oriented.

Build Service-oriented High-end Financial Product Experience to Boost Business Growth

Jinteng Technology is a technology company invested by China International Capital Corp and Tencent. It not only is “digital innovation” under the system of China International Capital Corp,but it also supports establishing “private service” within Tencent ecology. Jinteng Technology assists CICC Fortune to speed up management business transformation and realize scale development by supplying technological platform development and digital operation support.

To service high-net-worth customers better in a differentiated way, China Merchants Bank and China Construction Bank set “private bank”. Ant Group and Tiantian Fund set a “High-end financing” special zone. Howbuy Fund set a particular zone of “at least one million”, and Jingdong Financial Technology created the “Dongdong Youyu” App...

CICC is a broker-dealer noble with rich experience in serving high-net-value customers. For example, the private account service of “China 50” of CICC Wealth Management requires at least 10 million. The cumulative scale of “China Top 50” has exceeded 20 billion from July 2019 to March 2021.

The workshop will share with you: In the light of high-net-value customer purchasing financial products, how to apply service design to connect “online” and “offline” experience paths in the before, during, and after stages. Focusing on users, assets, and investment advisors, build a “heart-to-heart high-end wealth management platform” from nothing.

What you can learn from this workshop

1. Difference between high-end financing and inclusive financing

1.1 Difference of targeted users

1.2 Difference of user demands

1.3 Difference of service methods

Case analysis: “China 50” product, which requires at least 10 million. More information and manual services are needed to carry out investor education and help customers with their decision.

2. How to integrate “online” and “offline” modes to build a user-centered “service” high-end financing platform

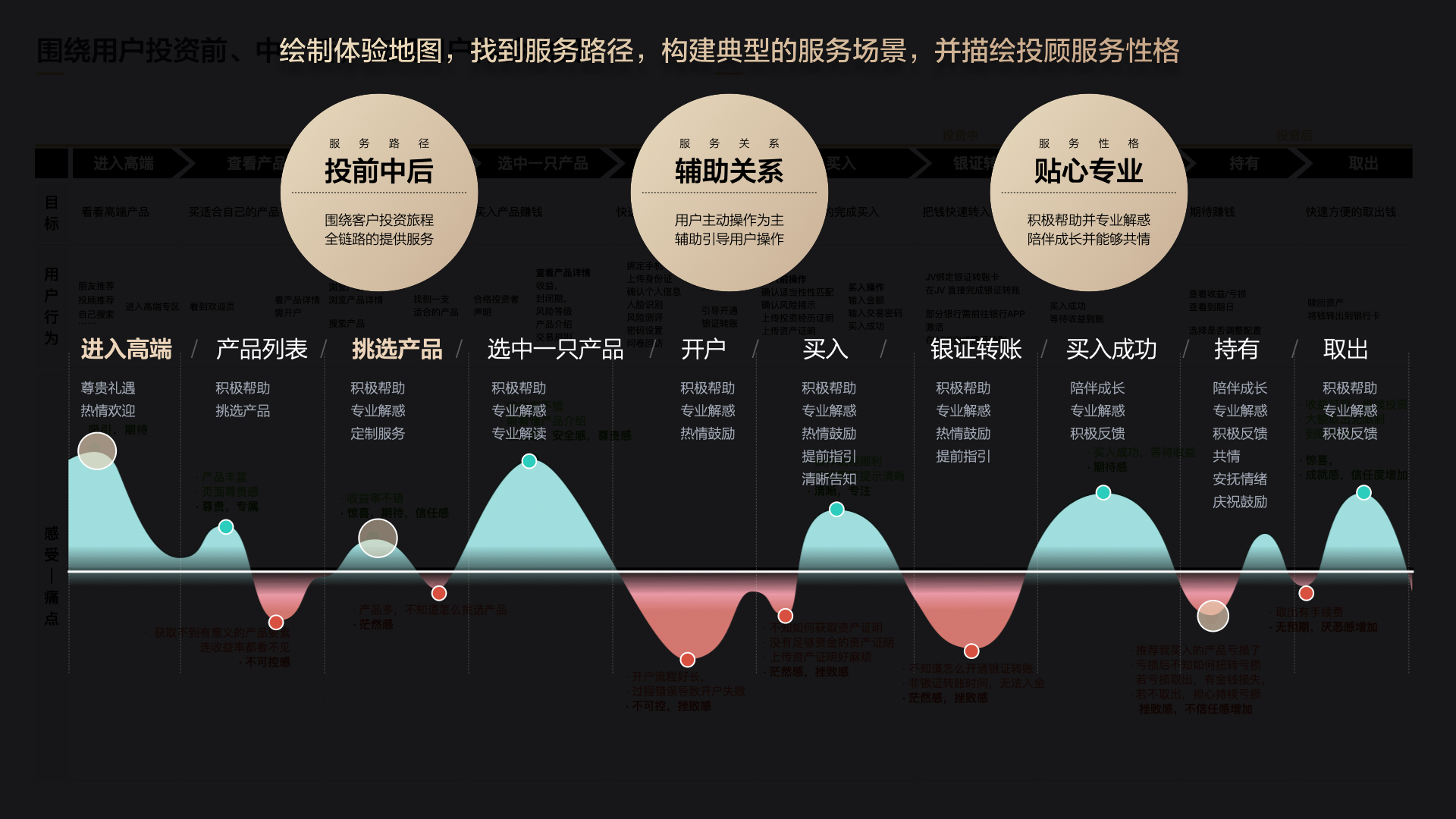

2.1 Discern highlights of user experience and create a peak experience

2.1.1 Classification and portrait of high-net-value customers

2.1.2 User service blueprint

2.1.3 User experience map

2.1.4 Evacuate service opportunity point and define peak experience contact

2.2 Focus on peak experience touchpoint and create a perfect user experience in user end

2.2.1 Identification of high-end and noble identities

Case analysis: Welcome page which meets users’ demand in different scenes

2.2.2 Simple and smooth perfect experience

Case analysis: Within compliance standards, create a straightforward account opening process

2.3 Focus on peak experience touchpoint and provide enthusiastic heart-to-heart “investment consultant” service

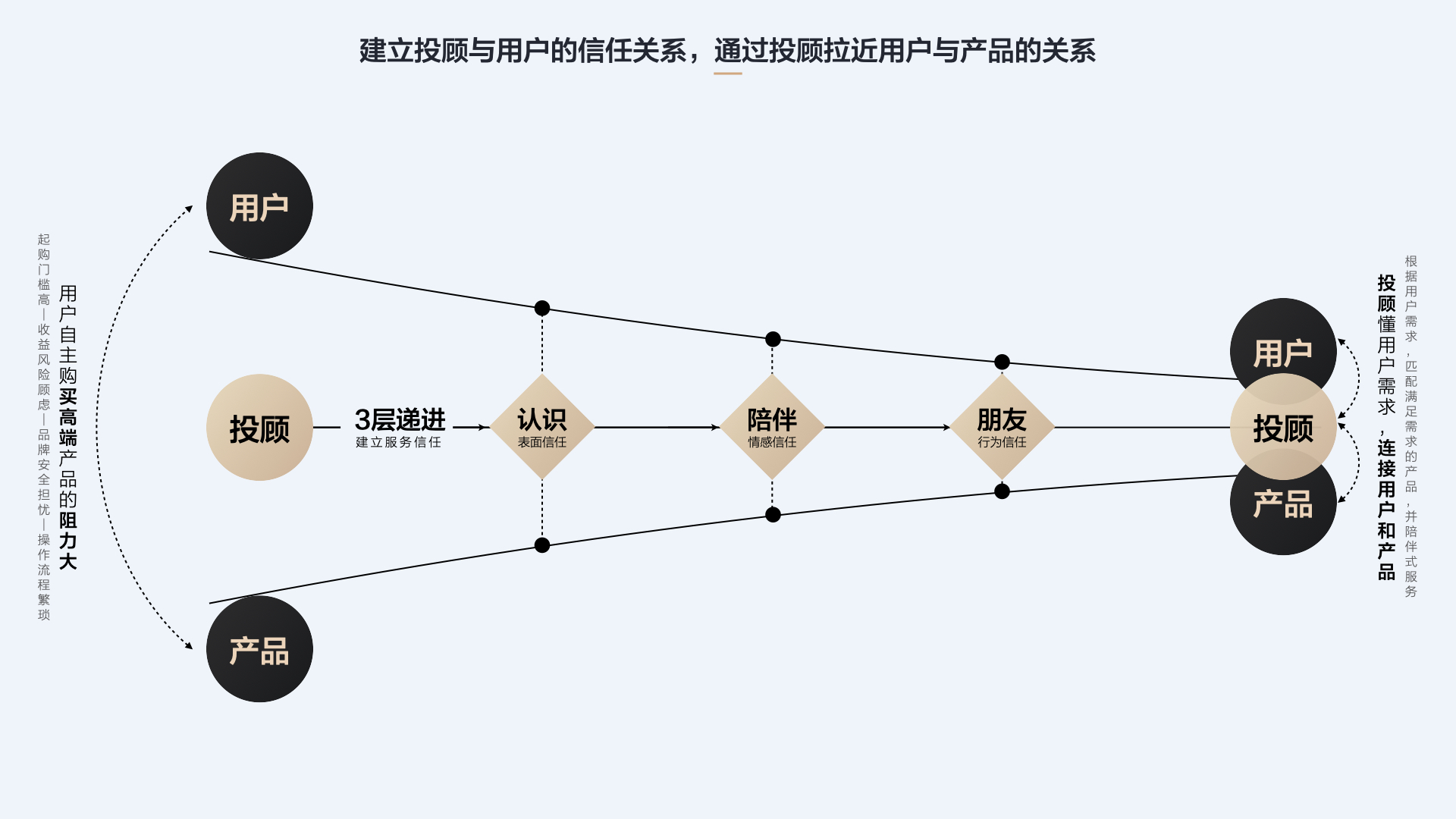

2.3.1 Three progressive relations of investment consultant and establishing service trust with users

2.3.1.1 Meet: Superficial trust

2.3.1.2 Accompany: Affective trust

2.3.1.3 Friends: Behavior trust

Cases analysis:

A. How to integrate “online” and “offline” service to provide customized assets allocation service for users

B. How to make accurate positioning on customers and provide “Mini 50” assets allocation service which requires at least 2 million for a user.

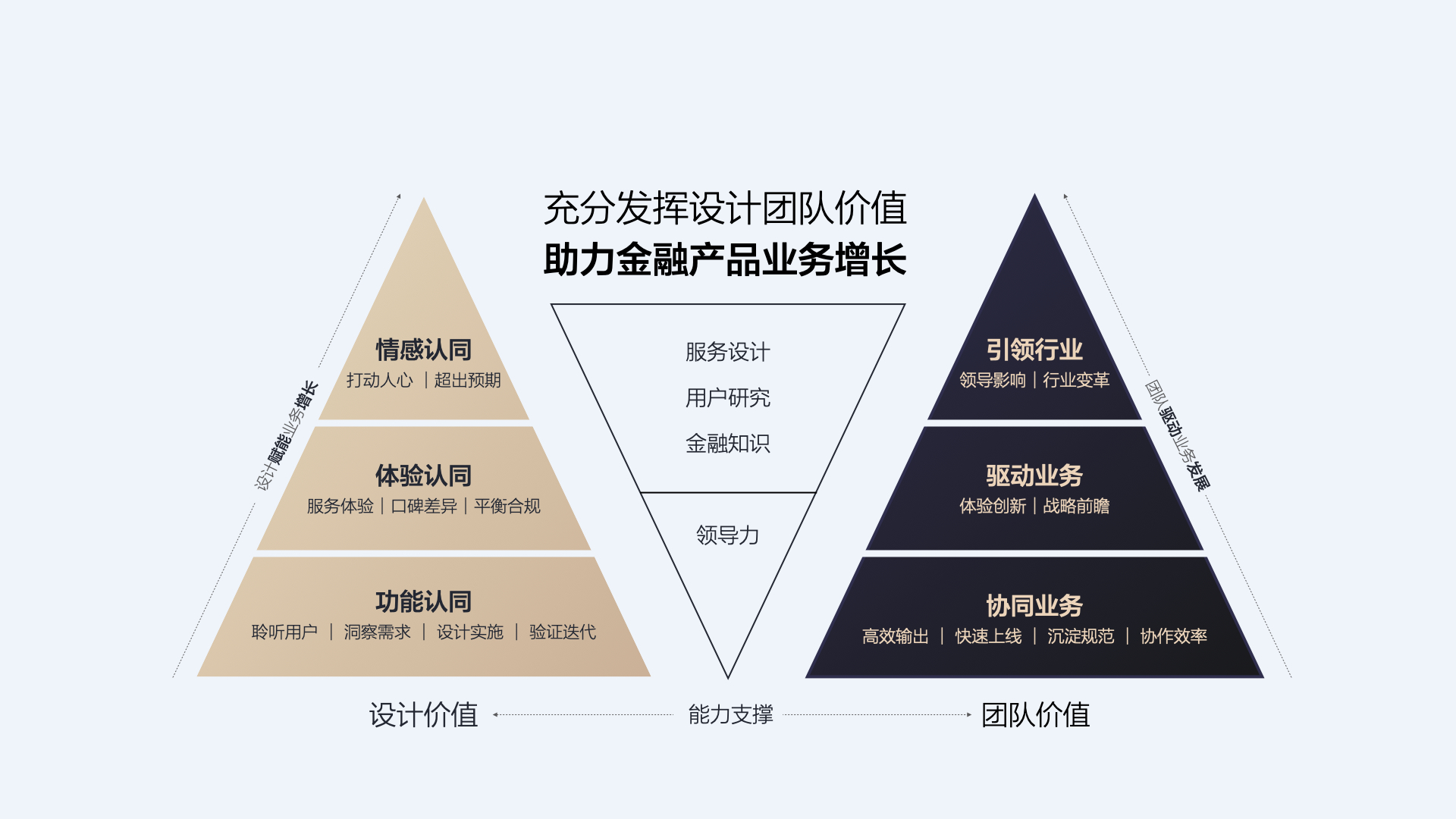

3. Build an effective and coordinated design team to promote business growth from nothing

3.1 Standardize design procedure

3.2 Establish design resources pool

3.3 Formulate design rules

1、Workshop introduction: Introduction to the high-end wealth management platform of CICC Wealth, understanding the difference between high-end wealth management and inclusive finance (30 minutes)

2、Case analysis: How to create a “high-end wealth management platform that understands you” through service design (1.5 hours)

3、Practical interaction: Discuss in groups, divide the user’s product purchase process into before, during, and after purchase, try to use the method of service design, connect users experience and investment investment consultant services, and then de

4、Open Q&A; accessible communication in Q&A session (20 minutes)

5、Summary review (10 minutes)

1、 Interaction designer, product experience designer, visual designer

2、Product manager, operations manager

3、Relevant practitioners who are interested in Internet finance

1、Understand the user profile and financial needs of high-end wealth management products

2、 Learn to use service design methods for online + offline financial product experience design

3、Through case analysis, understand how high-end financial products can effectively increase product sales through accompanying “person” services

4、Understand how designers and design teams can empower business and build their influence during project development

-

Pain points of high-end users

Pain points of high-end users

-

High-end experience design principles

High-end experience design principles

-

Investment consultant relationship in Jinteng

Investment consultant relationship in Jinteng

-

Establish a trustworthy investment consultant relationship

Establish a trustworthy investment consultant relationship

-

Investment consultant services in critical nodes

Investment consultant services in critical nodes

-

Design preception: give full play to the value of the design team and help financial product business growth

Design preception: give full play to the value of the design team and help financial product business growth

-

Core business supports high-end service platform

Core business supports high-end service platform

-

Jinteng Technology-Assist in building “Private Banking Service” in Tencent Ecosystem

Jinteng Technology-Assist in building “Private Banking Service” in Tencent Ecosystem