-

Kevin Chang

Ximalaya

UED Director

Kevin Chang

Ximalaya

UED Director

Experience Helps the Digital Transformation of Pacific Insurance Life Insurance

In recent years, digital technologies such as big data, cloud computing, artificial intelligence and blockchain have been increasingly integrated into the whole process of economic and social development, and have gradually become a key force affecting global competition. Last year, the People's Bank of China issued the Fintech Development Plan 2022-2025, which further put forward the requirements for digital transformation, and accelerated digital development has become an important factor in national economic development. The insurance industry is an industry dealing with risks. From the initial product design to subsequent underwriting and claims settlement, rigorous and complex risk models or mathematical technologies are involved.

Behind the transformation is the change of internal and external environment of the industry, from the disappearance of demographic dividend, the advent of low interest rate era, the comprehensive upgrade of customer demand to the sluggish economic environment. All these urgently require the business model of life insurance companies to transform from the original extensive growth to the high-quality development model, from the crowd tactics, sales is king, interest rate drive to professional, technology driven, customer driven transformation.

1、Transformation scenario

· Aiming at customers' pain point needs in the "post-epidemic" era, China Pacific Life Insurance takes digital technology as the core driving force to enable insurance sales, service and management, and upgrades the whole process of operating services such as intelligent underwriting, intelligent claims settlement and intelligent customer service. Through online and offline integration of experience link design to improve the traditional insurance sales industry customer management efficiency and customer experience.

1.1 Expand online business scenarios, one-stop "to meet service needs and make customers more comfortable

· Upgrade intelligent underwriting services. Through process optimization and AI support, focusing on user experience and management efficiency, it can realize rapid booking and convenient insurance, intelligent double recording and real-time quality inspection, transparent orders and three-party visibility, accelerate the problem processing timeliness, and realize the whole process online and transparent. The underwriting timeliness is 0.36 days, and the NPS of interactive insurance is 83%.

1.2 Take the initiative to follow the whole journey, precise positioning of service demands, and make customers more relaxed

· On the basis of full coverage of online service channels and completion of the construction of intelligent online interactive service platform, China Pacific Life Insurance gathers strength to create full-journey, scene-oriented and personalized active following services: When a customer receives a notice or service break point, Yangyang customer Service will directly get involved and visually show the required operation plan or FAQ to the customer, realizing the transformation from "customer looking for service" to "service looking for customer".

1.3 Multi-scenario enabling team to show business and provide professional insurance policy services to make customers more assured

· Promote service capability through diversified innovation, and carry out service throughout the whole process of pre-sale, in-sale and after-sale to achieve all-channel and all-journey service coverage; Driven by digital intelligence innovation, the company builds personalized and accurate recommendation models, provides precise services for business partners, and helps the company's business team to deepen its transformation to the direction of professionalism, specialization and digitalization.

2、Case introduction

· Digital transformation of agent exhibition tools

· Science and technology personal insurance and data intelligence platform

1、Senior experience designer

2、Design director

3、Financial industry related employees

1、Understand the role of experience methodology in the digital transformation process of Pacific Pacific

2、Find out what the experience team is doing in the digital transformation process

-

Play a role in the future

Play a role in the future

-

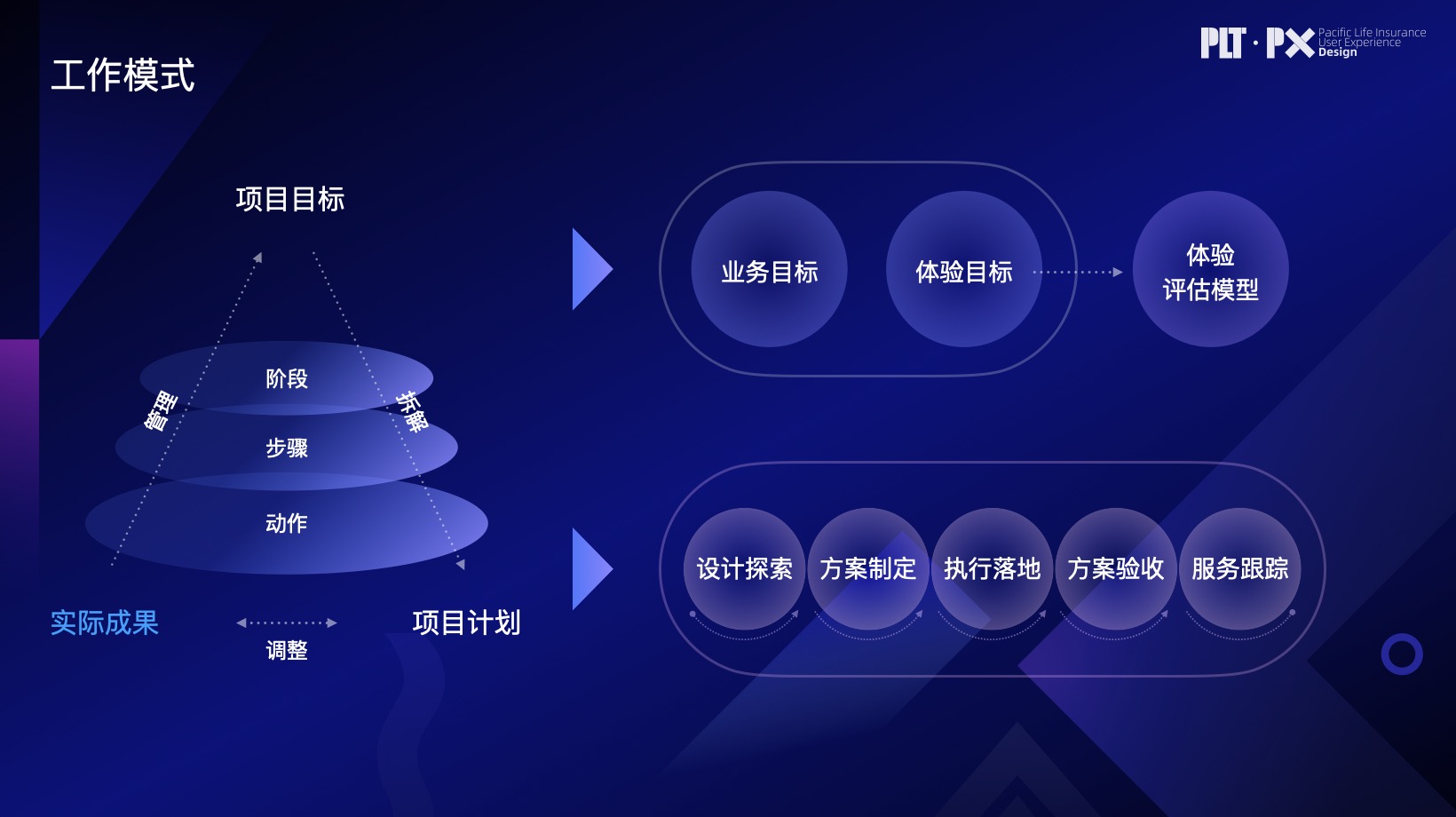

Operating mode reference

Operating mode reference

-

Official micro experience optimization

Official micro experience optimization

-

An overview of science and technology

An overview of science and technology