-

Jiang Jingjing

PingAn Securities. Ltd.

The head of UED team

Jiang Jingjing

PingAn Securities. Ltd.

The head of UED team

with 10 years of experience in Internet Design and Management. Charged of Interaction and Design work in eBay and Ctrip. Good at designing Internet products,OTA,mobile Internet,financial Internet.

Customer segmentation enables the whole-scene service design of financial products.

Customer value segmentation is the basis of identifying and focusing on important customers, and it is an advantageous means to guide the value-based refined experience improvement of products. Enterprises can determine the level of available resources according to customer value, and formulate differentiated product service design strategies for different customers so as to achieve refined user operation and increased enabling.

Ping’an Securities adheres to the service concept of "user experience first", continuously exerts force on the innovation of Internet technology, and use the customer segmentation method to do the refined improvement of service experience for customers. In three years, Ping’an Securities quickly gets promoted from an unknown small third-category securities trader to a medium-sized securities trader (ranking the 11th), and ranks the first place in the brokerage (retail) customer industry.

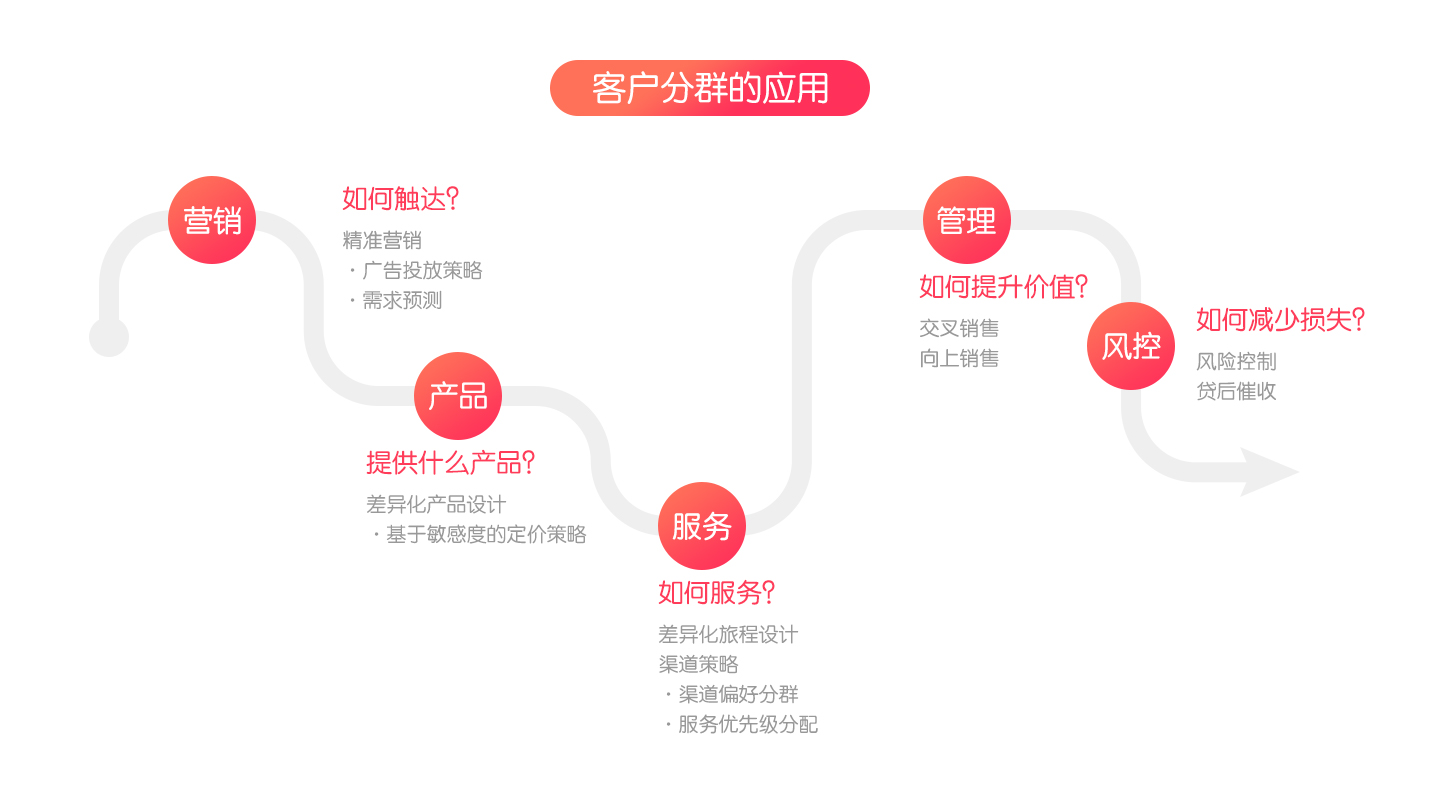

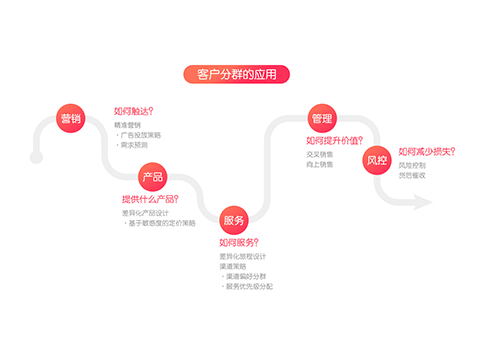

As experience designers in the revolution of financial industry, how do we apply customer segmentation methods and experience strategies to drive business decisions and enhance online and offline full-scene service experiences. Customer segmentation methods are, through data modeling and analysis, deeply understand your user behaviors, evaluate marketing effects, optimize product experiences and improve operational efficiency, and while exploring the key behaviors of different businesses, perceive the stories behind the indexes; find new opportunities for business growth through the index results of customer segmentation, and drive the boss, products, markets and operations for business decisions.

The discussion of this course focuses on the classification method of customers of financial Internet products, and gives explanations combined with specific cases of insurance, banking, credit cards, securities traders and other financial industries, and conduct explorative learning based on the issue which differentiated services can be done according to different user types.

1. Introduce the basic method, type, index and model of customer segmentation

2. Describe the experience of customer segmentation in financial industry combined with actual case analysis

3. Introduce differential experience designs for different customers' needs according to the results of customer segmentation.

4. Field practice: customer segmentation practices and group discussions

5. Summary and comment

1. Designers, researchers, product managers, operators in pursuit of progress

2. Practitioners or Internet finance practitioners of traditional financial industry

3. Experience decision-makers or innovation experience managers of business models

1. Methods of customer segmentation, service strategies, service designs, differentiated designs based on customer needs;

2. Learn about how to grasp customer segmentation differences, formulate service strategies and enable businesses;

3. Refined financial service experience design ideas;

-

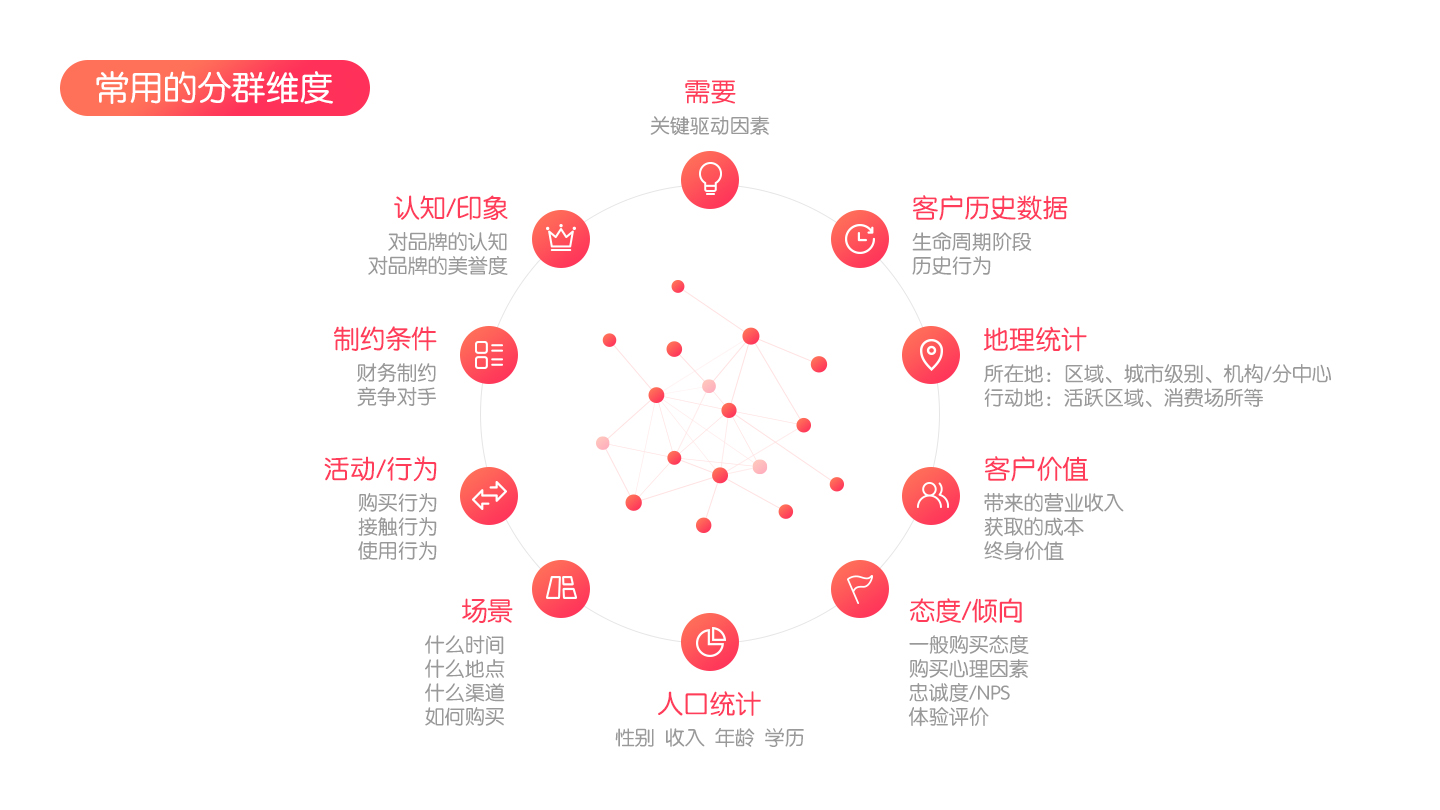

姜晶晶 - 客户分群维度

姜晶晶 - 客户分群维度

-

-

-

-