Financial Innovation

Financial Innovation

-

Fu Xiaozhen

Ant Financial

Senior Interactive Expert

Fu Xiaozhen

Ant Financial

Senior Interactive Expert

-

Tian Hui

LU.com

Product Department & General Manager of Mobile Platform

Tian Hui

LU.com

Product Department & General Manager of Mobile Platform

-

Zhang Bei

Tencent

Principle of Interaction Design

Zhang Bei

Tencent

Principle of Interaction Design

-

Qu Jia

UXC

Leading Official

Qu Jia

UXC

Leading Official

New Experience of Constructing Financial Products

In recent years, technology and finance are frequently mentioned. Both of them complement each mother—technology changes the appearance of finance, while financial development deepens the demands for technology. The powerful momentum of internet finance benefits from the advanced technology, data assets and the best experience design services, thus people can explore a commercial opportunity and conduct risk control more accurately. Under the circumstance, if enterprises want to stand out from the market, in addition to depend on technical means, the most important thing is to reinforce the experience of constructing sense of safety and let financial technology greatly connect with users.

As one of the driving forces in the new round technical revolution, AI is developed to the industrial application from technical R&D, its commercial development is secretly changing the internet financial field. Internet financial products are always accompanying with high risks, huge mass and rapid policy changes in the high-speed development process. Designers not only need to comprehend and explore user appeal, but also should understand business logic and clearly define commercial targets. Designers can provide the better service experiences for users through design and connect user appeal with commercial targets in the suitable life scene, so as to form the closed loop of commerce and experience

In this summit, we will discuss more trend cases brought by design experts in the innovation of internet financial products and discuss how to balance experience and technology and shape financial products with humanization, service experience, connective temperature, asset digitalization and life scenes.

-

Speech 1:《》

Speaker:Fu Xiaozhen ( Ant Financial,Senior Interactive Expert)

Work Case -

-

Speech 2:《》

Speaker:Tian Hui ( LU.com,Product Department & General Manager of Mobile Platform)

Work Case -

-

Speech 3:《》

Speaker:Zhang Bei ( Tencent,Principle of Interaction Design)

Chinese internet financial products are emerging endlessly. In addition to low thresholds, usability and security in tradition, it is necessary to value brands, earnings and policies or other core product elements of affecting life cycle of financial products and user cognition, how to “update service anticipation to earning anticipation” in experience design, how to solve the core competitiveness of financial consumption products in the platform, and how to set up the basic financial product value that “shoemakers aim to make shoes for people, instead of making money” implying that it is necessary to change the idea, solve problems in the initial stage, and solve marketing problems before placing commodities on good shelves, so as to reach the core purport—create customers, and how to produce products that conform to user demands—the core appeal of marketing-oriented innovation. By sharing and analyzing “WeChat tickets”, “WeChat credit cards”, “Tencent Micro-gold” and “Wisdom Campus”, we will display the new strategy based on marketing-oriented experience positioning. It is believed that new financial products are not one-to-one offline sales or mass promotion, but the financial consumption experience that everyone will use and it has the self-vitality, transmissibility and socialization.

Work Case -

-

Speech 4:《》

Speaker:Qu Jia ( UXC, Leading Official)

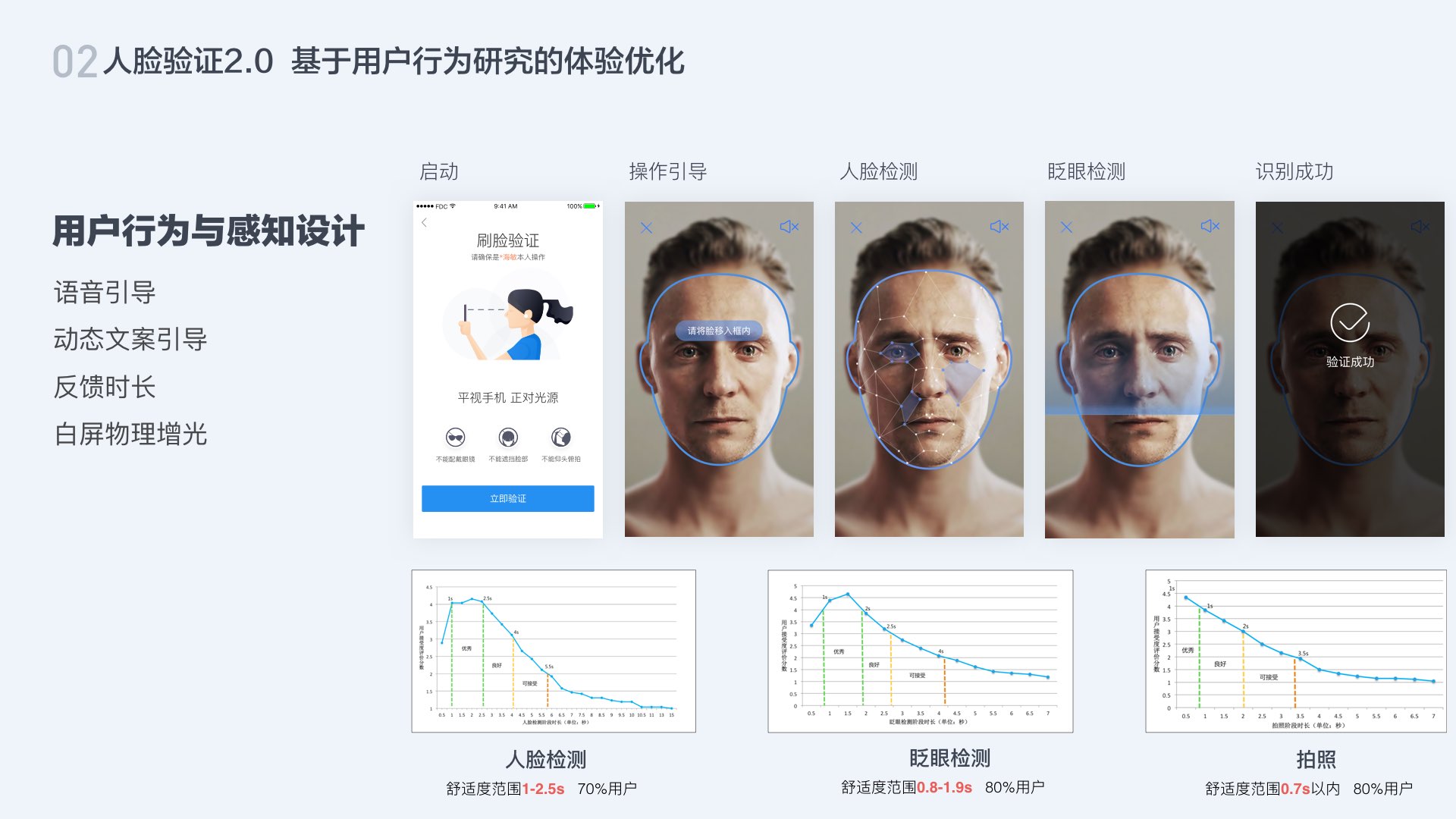

Baidu Finance proposes the concept of “AI FIntech” to combine the most advantageous AI technology with financial scenes in Baidu and explores and practices in the fields of intelligent acquisition, status identity, big data risk control, intelligent consulting and intelligent customer services. How can we explore user experience design and find out design value point of energizing business in the product process of financial technology?

Sharing will regard Baidu Finance credit financial service multi-channel to gain customer experience process design and provide the design reflection on sharing financial technology in financial services. The specific contents are shown as follows:

Essence reflection on financial technology

Experience design model construction of financial technology

Measures of implementing financial technology scenes

Face identification design case

Design model

Work Case -

1. Designers

2. Product managers

3. Enterprise managers

4. Employees in internet finance

1. Learning innovative industrial cases and methodology

2. Combine with the brand-new technology to master the financial industry

3. Master the brand-new design opinions and observation