Digital Finance Summit

Digital Finance Summit

-

Zhang Le

CMB

Experience Design Manager

Zhang Le

CMB

Experience Design Manager

I have 14 years of working experience. I am currently working in China Merchants Network Technology, responsible for the customer operation of the experience design team and the design office of the staff service section. I have accumulated rich working experience in traditional brand design, including 4A advertising, interactive multimedia and Internet design. I have trained many designers, and now I am working in various big factories. I have led a 30-member comprehensive design team (UIuu.UE), a vertical business design team for marketing. I am good at building teams from 0 to 1 and have the ability to integrate design teams. I have years of experience in the design field, covering a wide range of fields. I provide design solutions that optimize the experience for the business side.

Design concept: Under new technologies and new scenarios, redefine experience design standards, create high-quality user experience in the commercial environment of the financial field, refine design management to enable employees to serve customers, and empower the financial field.

-

Liu Shuangxi

Ant Group

Senior Experience Design Specialist

Liu Shuangxi

Ant Group

Senior Experience Design Specialist

He used to be an Alibaba 1688 design expert, responsible for the experience design of commercial product lines, and is now in charge of the financial credit design team of MYbank. Focusing on financial service experience design, he has output topics such as "MYbank Intelligent Guidance Design" and "Rural Financial Trust Design", and participated in the compilation and book publication of Class B experience design practice "U Point · Material - Alibaba's 1688UED Experience Design Practice Road".

Design concept: We hope to translate complex financial services through design and translation, better link customers, so that small and micro customers can understand and use well.

-

Zhang Hao

ICBC

Senior Fintech Manager

Zhang Hao

ICBC

Senior Fintech Manager

I am a senior fintech manager at ICBC. I joined ICBC in 2004 as the Design Director of the user Experience team. I have been engaged in financial experience design for 19 years and have rich experience in design management and team building. I participated in the construction of ICBC experience design professional team from 0 to 1, and built a full-methodology experience design work system that is "idea-based", "method-based", "system-based", "digital-supported" and "people-driven".

Design concept: With the design vision of "feeling users' feelings and exceeding users' expectations", we enable professional team construction and management, and continue to build a professional financial design team.

-

Kevin Chang

CPIC

Senior Experience Design Expert

Kevin Chang

CPIC

Senior Experience Design Expert

I am a senior experience design expert of Pacific Life Insurance. I graduated from Shanghai Jiao Tong University with a master's degree and have 14 years of experience in the user experience industry. I have been the director of UED in Himalaya for 6 years, managing a comprehensive design team of more than 50 people. I have been engaged in experience design in Internet and software industries such as Meituan-Dianping and HP for many years, and have had O2O entrepreneurial experience. I have been awarded the IXDC Top Ten Outstanding Speaker (2021) and the Nomination Award of Top Ten Outstanding Young People in China Service Design Industry in 2022. I am currently in charge of the individual insurance design team of China Pacific Insurance, focusing on the whole link experience design of individual insurance.

Design Philosophy: The key to achieving experience goals is to find a balance between user needs, business goals and technical implementations.

-

Zhao Yongchang HOLA Co-Founder

Engaged in the user experience industry for 14 years. With 8 years of experience experience design and management experience and 6 years of experience in enterprise customer experience consulting services, he has served Tencent, ByteDance, China UnionPay, Industrial and Commercial Bank of China, China Construction Bank, China Merchants Bank, Minsheng Bank, China CITIC Bank, Industrial Bank, Bank of Beijing, Bank of Jiangsu, Chinese Bao, to achieve experience pricing strategies under digital transformation for enterprises at different stages of development, including consumer insight, user experience, trend research, etc. in many fields of research and services. Respect the truth, use retroactive thinking to explore and understand the world, and provide new value and meaning for people's lives.

-

Dai Kui Jiangxi Bank General Manager of Internet Finance Department

-

Zhang Yang Du Xiaoman Senior expert in user experience design

Currently, he is a senior expert in user experience design of Du Xiaomman Financial User Experience Department. He joined Baidu in 2014 and has been responsible for the 0-1 design experience exploration and product polishing of Baidu Travel business, Baidu Stock Market Connect, Baidu Finance and other products. Du Xiaoman, formerly Baidu Finance, inherited Baidu's technical gene and explored the application of artificial intelligence in the financial field. It has successively distributed six business segments, namely credit, wealth management, payment, insurance, personal financial technology and supply chain financial technology, and was formally separated and independent in 2018. After being split into Du Xiaoman, I continued to be responsible for the overall interactive experience output of various products such as wealth management, fund, stock, payment and credit in Du Xiaoman's financial wealth direction, completed a series of innovative experience attempts, helped the growth of talent system within the team, and established the product's service experience recognition in the industry.

Design concept: The experience and innovation of finance is more like picking a circle from a square. Through continuous understanding and learning, we can find the boundary of industry and user cognition, and draw the largest circle within the boundary with service innovation thinking, so as to provide users with recognizable financial service experience.

Digital Technology Enables the Transformation of the Financial Industry

Smart finance is the development trend of fintech in the future. It relies on Internet technology and uses digital technology means such as blockchain, big data, artificial intelligence and cloud computing to comprehensively improve the wisdom of the financial industry in business process, business development and customer service, and realize the wisdom of financial products, risk control, customer acquisition and service. Driven by the empowerment of fintech and industry competition, financial service institutions have raised digital transformation to the level of enterprise strategy. "Customer experience" and "operation efficiency" are the core keywords of enterprise competitiveness. All kinds of financial institutions still need to continuously improve in organizational management, product service and business process.

How to build digital fist products and strengthen users' brand perception in financial industry? How to refine the stratified target customer groups, so that digital marketing efficient reach? How to improve the penetration rate of digital scene and explore forward-looking domain layout? These industry pain points are our challenge.

The summit will invite leading financial experts from ant group, China Merchants Bank, ICBC, Pacific Life Insurance, Jiangxi Bank, Hylo Dream experience consultancy and others to gain insights, to share their outstanding experiences and cases, to inspire the industry to reflect on the changing situation, to use design to lead the creation of value, to enhance customer experience, to enhance the competitiveness of enterprises to achieve business success.

-

Speech 1:《Digital Transformation of Fintech -- Integration of Experience Design》

Speaker:Zhang Le ( CMB,Experience Design Manager)

Our country established the consumption Internet in the past 20 years in the development process of Internet, and has already become the super application country of Internet. In recent years, enterprise software can reshape enterprise value objectives through the design and layout of research and development, transaction, distribution and other links, but the development of this field is still slow. In the post-Internet era of the financial industry today, digital transformation has become an important driving force for the development of the banking industry, but it also faces a series of challenges in this process. For example, limited by the original IT architecture, it cannot meet the requirements of high concurrency and high-frequency iteration. The continuous increase of the online scene, the connection with the external ecology leads to the long management chain, the emergence of new risk exposure beyond the traditional credit risk, and so on.

Therefore, establishing an experience design team can empower enterprises in digital transformation. The team needs to explore and adopt a variety of design methods, and strive to build a sound production model to facilitate and integrate with the trend. Therefore, the production model needs to reach the industrial level to facilitate the digital transformation of the enterprise. This summit presentation will show you how this production model works in the current environment by analyzing some specific cases.

The main contents of this speech include:

1、Background and development trend of the financial industry -- demands of enterprises' digital transformation

2、Current situation and challenges of enterprise products within financial enterprises

3、The experience design team can enable the enterprise transformation method and industrial production mode according to the current situation

3.1 Current situation and solution of B-terminal product design of enterprise level

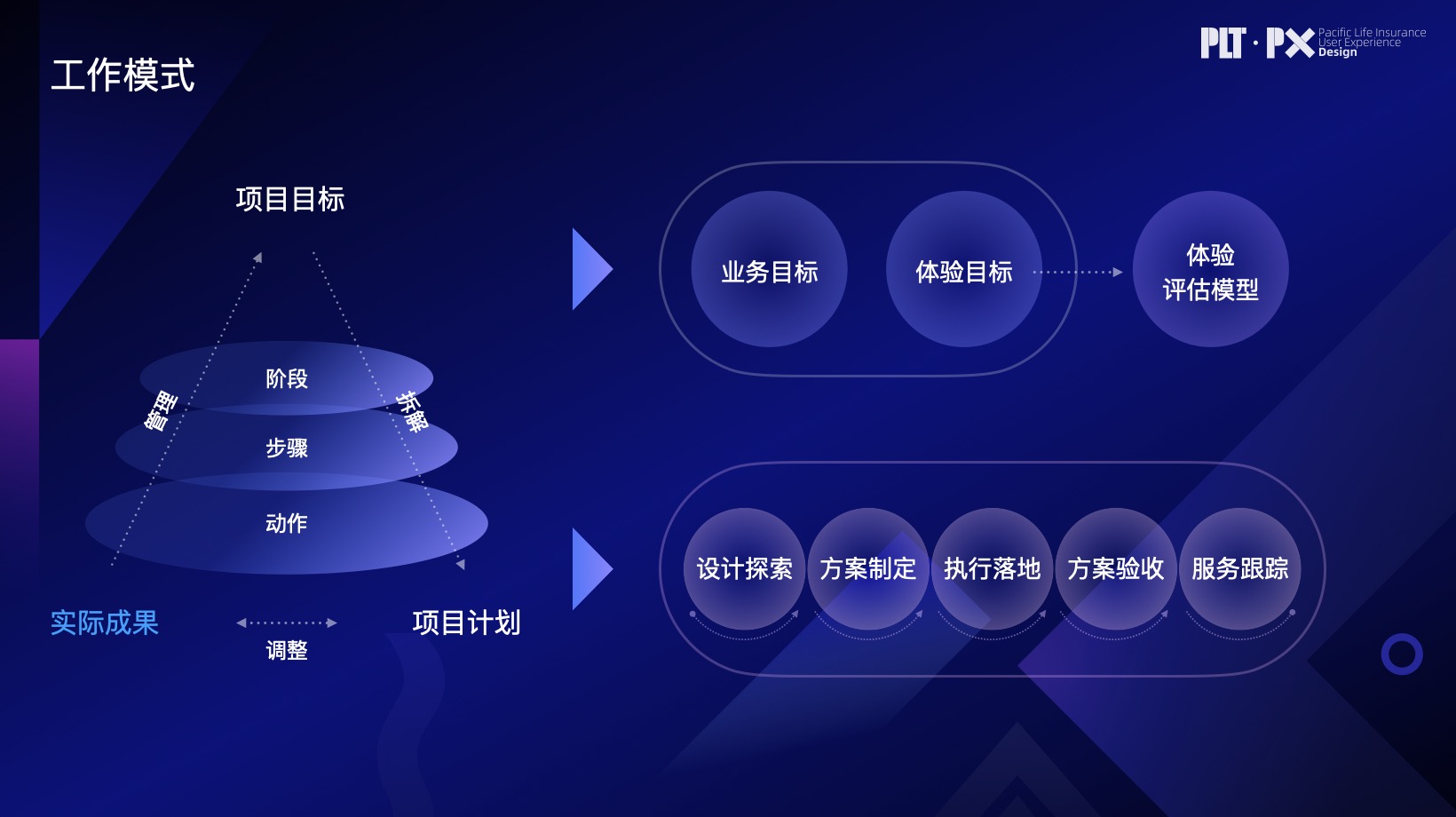

3.2 Working methods of the design team

3.3 Structure and operation mode of industrial production mode

4、The landing of industrial production mode

Work Case-

Digital transformation The current open and integrated organizational model of banks

Digital transformation The current open and integrated organizational model of banks

-

On the basis of enterprise digital direction core design team's core mission

On the basis of enterprise digital direction core design team's core mission

-

The design mode and system of experience design team in digital transformation

The design mode and system of experience design team in digital transformation

-

How does digital transformation experience design sop integrate into lean management

How does digital transformation experience design sop integrate into lean management

-

-

Speech 2:《Technology Drives the Upgrading of Banking Experience》

Speaker:Liu Shuangxi ( Ant Group,Senior Experience Design Specialist)

For small and micro customers, they hope that the bank service threshold is lower, the service depth is deeper, the service means is more diverse, in short, they hope that the bank can understand their business situation and the demand for financial services better. Especially as banking services move online, customers want more convenient and in-depth services. In the process of technological change, the financial services of the banking industry are also accelerating the pace of innovation in business, channels, product matrix and other aspects. These new changes make the experience design of the bank full of challenges and opportunities. In this context, experience design becomes more complex and subdivided.

Driven by rapid revenue growth and relying on science and technology, it is particularly urgent to build a new banking customer experience model, so that small and micro customers can feel the service around them thoroughly. From an experience-driven perspective, we have built three experience modes to upgrade the experience and increase revenue:

1、Human-intelligence experience design thinking model. In the process of transformation from HCI to HII, we should prepare for the level of design thinking based on banking business to guide our design work.

2、Customer decision efficiency design, the core of which is to unshackle the expression of financial words, seize the core driving decision factors at the key customer contact points, dig the influence factors according to the customer layer to boost growth, and promote the service efficiency through the influence factor model.

3、Three-layer service experience design based on "people", driven by science and technology, to build a three-layer advanced intelligent three-dimensional service experience of robots, digital people and real people. Let the mobile network become the real service counter of customers, so as to improve the efficiency of self-service.

4、Intelligent asset identification experience design. Self-employed households, small and micro enterprises, and operational farmers shall gradually deconstruct non-standard assets into effective asset certificates. Based on risk control model strategy and relying on scientific and technological means, digital design of objects, living assets and other assets shall be carried out.

Work Case-

Two-way video digital counter

Two-way video digital counter

-

Asset identification design case

Asset identification design case

-

Active service experience design

Active service experience design

-

The impact factor model drives business growth

The impact factor model drives business growth

-

-

Speech 3:《Construction and Thinking of Financial User Experience Design System》

Speaker:Zhang Hao ( ICBC,Senior Fintech Manager)

In the era of Internet finance, the way that users obtain and choose bank products is changing to Internet, self-service and personalized. The financial needs of users are no longer limited to simple product functions, but expanded to interactive friendliness, aesthetic interface and the resulting pleasure, sense of value and other subjective experiences. Icbc takes advantage of the Internet thinking to carry out the design of user experience and product usability. It pays attention to the user-centered and user-experience-oriented product iteration, draws lessons from the platformization and componentization of the Internet industry, and improves the user experience level of banking products with high quality rapidly through good planning and design, as well as the formulation and implementation of design specifications.

1、Based on the concept, establish a user-centered goal

1.1 Construction of ICBC user experience design system

1.2 Work contents of user experience design in the whole life cycle

2、Take methods as the guide to establish scientific and objective normative guidelines

2.1 User Experience Method Guide

2.2 Product Usability Design Method Guide

3、Improve the whole life cycle experience management based on the system

3.1 System and mechanism guarantee

3.2 Principles of user interface design

4、Build an experience design guarantee system with the support of numbers

4.1 Professional User Experience Room

4.2 Enterprise-level User experience Management Platform

5、Drive the professional upgrading of the experience team with personnel as the driving force

5.1 Experience of the Whole Bank Experience Officer team (internal and external users)

Work Case-

Enterprise mobile banking -- Structural upgrade

Enterprise mobile banking -- Structural upgrade

-

Personal mobile banking -- Experience upgrade

Personal mobile banking -- Experience upgrade

-

ETS User experience evaluation model

ETS User experience evaluation model

-

User Experience and product Usability Design Methodology Guide

User Experience and product Usability Design Methodology Guide

-

-

Speech 4:《Experience Helps the Digital Transformation of CPIC Life Insurance》

Speaker:Kevin Chang ( CPIC,Senior Experience Design Expert)

In recent years, digital technologies such as big data, cloud computing, artificial intelligence and blockchain have been increasingly integrated into the whole process of economic and social development, and have gradually become a key force affecting global competition. Last year, the People's Bank of China issued the Fintech Development Plan 2022-2025, which further put forward the requirements for digital transformation, and accelerated digital development has become an important factor in national economic development. The insurance industry is an industry dealing with risks. From the initial product design to subsequent underwriting and claims settlement, rigorous and complex risk models or mathematical technologies are involved.

Behind the transformation is the change of internal and external environment of the industry, from the disappearance of demographic dividend, the advent of low interest rate era, the comprehensive upgrade of customer demand to the sluggish economic environment. All these urgently require the business model of life insurance companies to transform from the original extensive growth to the high-quality development model, from the crowd tactics, sales is king, interest rate drive to professional, technology driven, customer driven transformation.

1、Transformation scenario

1.1 Expand online business scenarios, one-stop "to meet service needs and make customers more comfortable

· Upgrade intelligent underwriting services. Through process optimization and AI support, focusing on user experience and management efficiency, it can realize rapid booking and convenient insurance, intelligent double recording and real-time quality inspection, transparent orders and three-party visibility, accelerate the problem processing timeliness, and realize the whole process online and transparent. The underwriting timeliness is 0.36 days, and the NPS of interactive insurance is 83%

1.2 Take the initiative to follow the whole journey, precise positioning of service demands, and make customers more relaxed

· On the basis of full coverage of online service channels and completion of the construction of intelligent online interactive service platform, China Pacific Life Insurance gathers strength to create full-journey, scene-oriented and personalized active following services: When a customer receives a notice or service break point, Yangyang customer Service will directly get involved and visually show the required operation plan or FAQ to the customer, realizing the transformation from "customer looking for service" to "service looking for customer"

1.3 Multi-scenario enabling team to show business and provide professional insurance policy services to make customers more assured

· Promote service capability through diversified innovation, and carry out service throughout the whole process of pre-sale, in-sale and after-sale to achieve all-channel and all-journey service coverage; Driven by digital intelligence innovation, the company builds personalized and accurate recommendation models, provides precise services for business partners, and helps the company's business team to deepen its transformation to the direction of professionalism, specialization and digitalization

2、Case introduction

· Digital transformation of agent exhibition tools

· Science and technology personal insurance and data intelligence platform

Work Case-

An overview of science and technology

An overview of science and technology

-

Official micro experience optimization

Official micro experience optimization

-

Operating mode reference

Operating mode reference

-

Play a role in the future

Play a role in the future

-

1、Design Director

2、Experience design practitioners

3、Relevant employees in the financial industry

4、Middle/high-level user experience design manager

5、Relevant practitioners interested in full-link experience optimization

1、Understand the design form of the bank's core credit business

2、Understand the problems faced by integrating experience design into enterprise development process

3、Understand the new changes of financial product experience design under the current background

4、Find out what the experience team is doing with the digital transformation

5、Explore the practice of user experience design management in specific financial products