-

Mao Yiyao

Mybank

Senior UX Design Expert

Mao Yiyao

Mybank

Senior UX Design Expert

Head of Wealth Management Design at MyBank's Design Center, Senior User Experience Design Expert, Master of Design, with 9 years of experience in internet finance design (3 years in creative design, 6 years in user experience design). Experienced in brand marketing, platform-based services, and vertical business operations. Led the team to build MyBank’s wealth management product experience from 0 to 1, focusing on service drivers and intelligent innovation design. Aims to empower SME users to better adopt, understand, and apply financial services.

Design Philosophy: "Design makes finance beautiful and simple."

AI-Driven Intelligent Innovation in Bank Wealth Management Design

MyBank is dedicated to serving small and micro enterprises (SMEs), with nearly 130 million users engaged in wealth management services. SMEs often face strong liquidity demands, fragmented capital cycles, diverse financial goals, and challenges in understanding complex wealth management products. To enhance service quality and efficiency, MyBank has developed innovative solutions by constructing a three-tiered user experience framework: "User Identification - Need Matching - Decision Guidance." This approach enables tailored wealth management services that achieve breakthroughs in "Inclusiveness" and "Intelligence." This session will explore the design logic and practical insights behind MyBank’s data-driven wealth management system, aiming to improve the effectiveness of SME financial services.

Key Content:

1. SME Needs and MyBank’s Intelligent Inclusive Service Positioning

1.1 Characteristics of SME Financial Needs

1.2 MyBank’s Intelligent Inclusive Financial Product Positioning

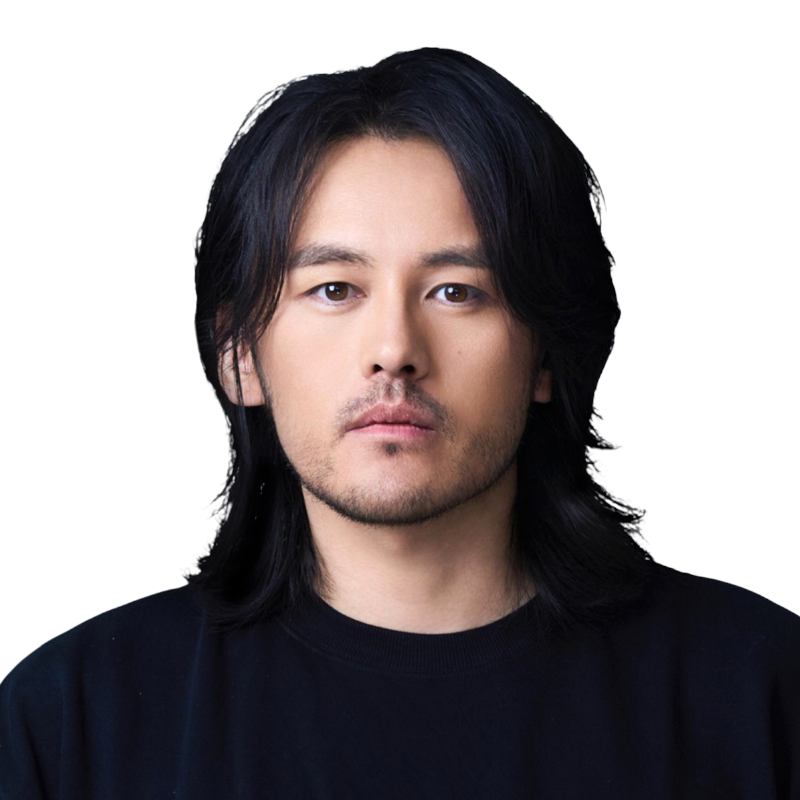

1.3 SME Inclusive Wealth Management Intelligent Solutions

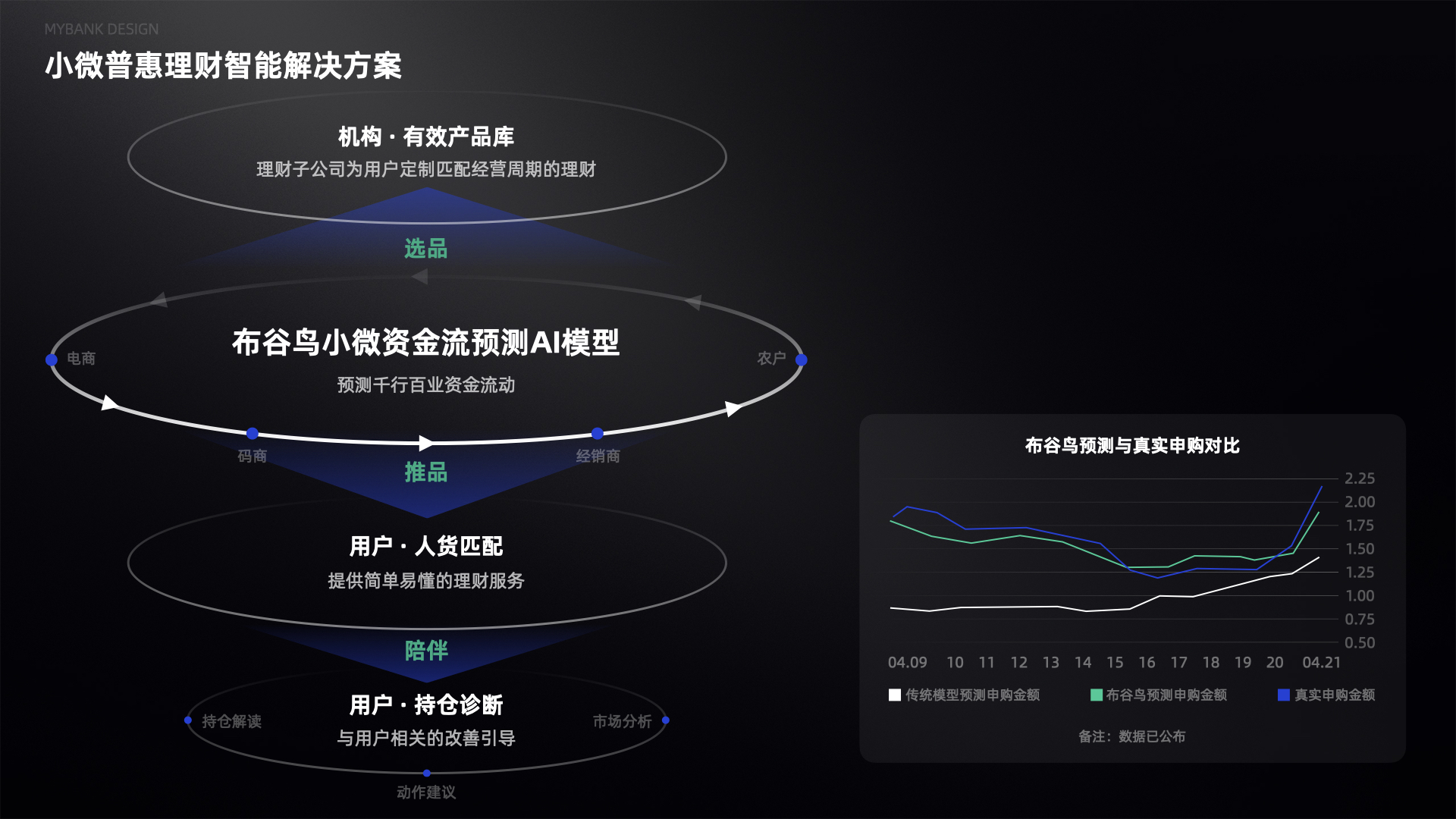

2. Intelligent Wealth Management Experience Architecture

2.1 Platform Product Framework:Establish product entry standards based on user needs, creating "mass-market products" (core products with broad appeal).

2.2 User Perception Framework:Align product effectiveness with user mindsets by leveraging the "three elements of wealth management" (risk, return, liquidity) and addressing user-specific cognitive differences.

2.3 Service Driver Factors:Build a driver factor library and translation system to deliver cognitive-demanded wealth management services (reducing complexity for user understanding).

2.4 Full-Scenario Intelligent Service Model:Integrate driver factors into AI-powered smart services, covering online and offline touchpoints to ensure seamless user experiences across all scenarios.

3. Intelligent Wealth Management Service Practices

Three-Tiered Experience Framework: "User Identification - Need Matching - Decision Guidance"

3.1 User Identification & Need Matching:Precise user profiling and intent recognition to optimize efficient product-user matching.

3.2 AI-Powered Customer Interaction Models:Training and calibrating AI models that simulate human decision-making logic (e.g., thinking chains) and incorporate driver factors for customer-centric interactions.

3.3 Decision Guidance:Addressing user pain points in wealth management journeys through intelligent solutions.The service model includes Smart GUI, Smart GUI & CUI Synergy, Smart CUI, and multimodal innovations such as digital human videos and AI-powered voice calls.

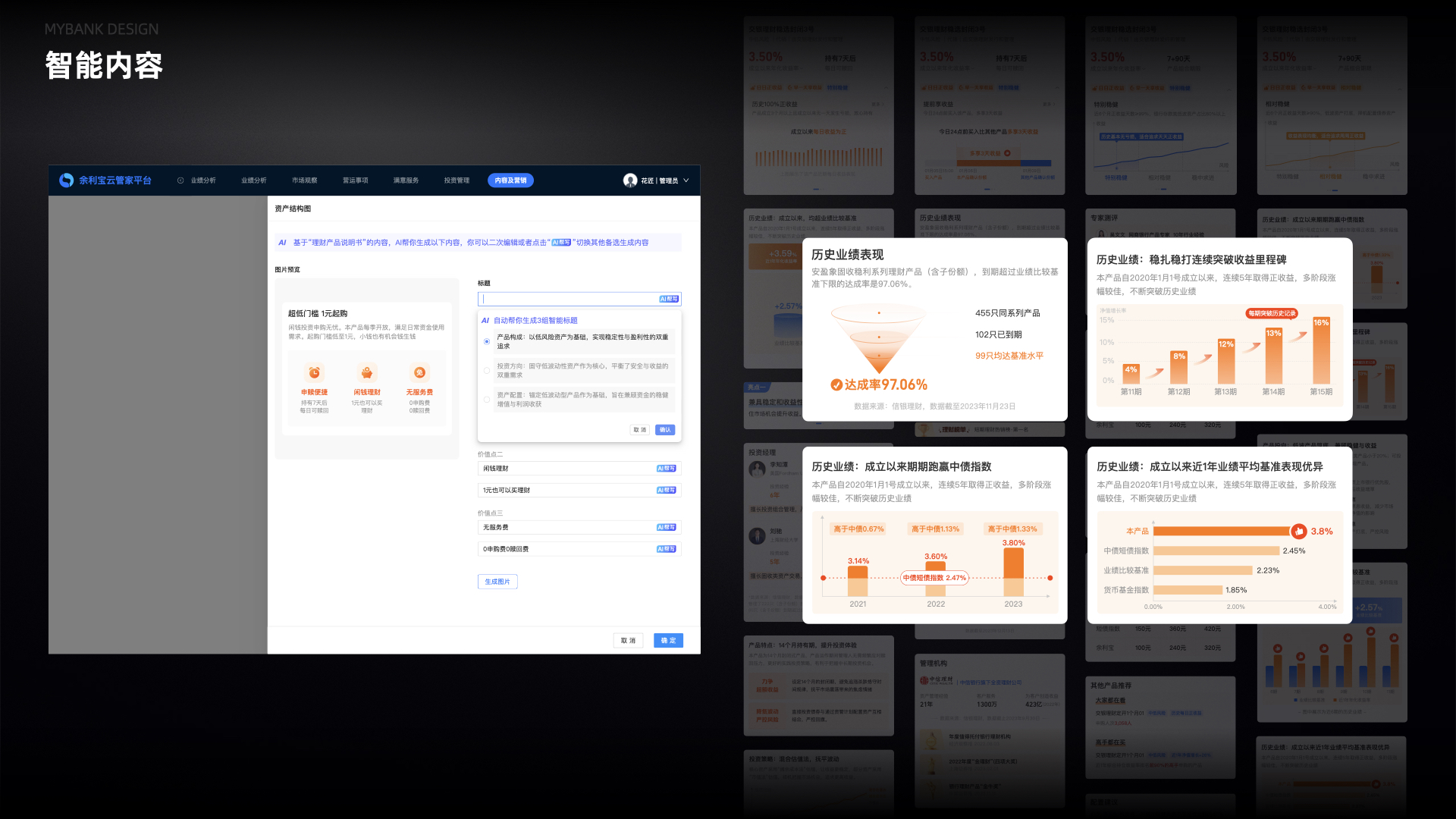

3.4 Intelligent Content:Building an intelligent content production pipeline to automate content generation and configuration, enhancing production efficiency.

4. AI-Driven Digital Banking Evolution

Future Exploration:Briefly outline MyBank’s future directions in AI-powered digital transformation, including advancements in personalized services, predictive analytics, and immersive user experiences.

1、Background Introduction

2、Practical Projects & Methodology Sharing

3、Topic Practice & Outcome Demonstration

4、Q&A

1、Entry-Level/Mid-Level UX Designers

2、Entry-Level/Mid-Level Visual Designers

3、Entry-Level/Mid-Level AI Designers

4、Individuals Interested in AI Design, and Professionals in Related Fields

1、Understand design thinking and strategies in the age of AI

2、Learn how to build an intelligent wealth management experience model based on "User Identification - Need Matching - Smart Guidance

3、Master the hands-on process of leveraging AI technology to drive business growth and optimize user experiences

4、Acquire methods for extracting and applying business drivers, as well as techniques for embedding these drivers into AI models to enhance customer communication

-

Inclusive Smart Wealth Management Solutions for SMEs

Inclusive Smart Wealth Management Solutions for SMEs

-

Smart Wealth Management Service Framework

Smart Wealth Management Service Framework

-

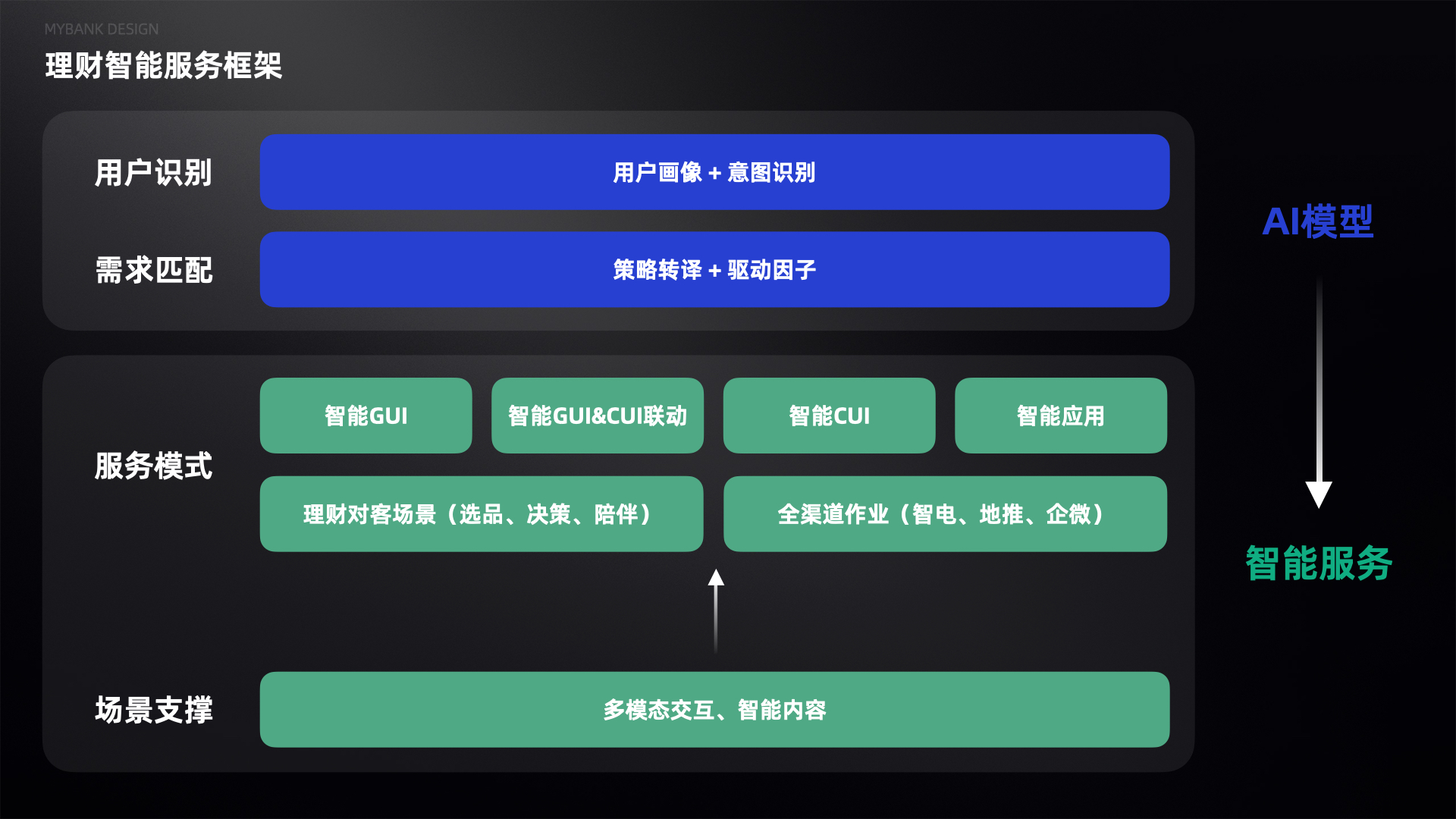

Customer-Facing AI Model

Customer-Facing AI Model

-

Intelligent Service Model

Intelligent Service Model

-

Intelligent Service Case Studies

Intelligent Service Case Studies

-

Intelligent Content

Intelligent Content