-

Liu Shuangxi

Ant Group

Senior Experience Design Specialist

Liu Shuangxi

Ant Group

Senior Experience Design Specialist

He used to be an Alibaba 1688 design expert, responsible for the experience design of commercial product lines, and is now in charge of the financial credit design team of MYbank. Focusing on financial service experience design, he has output topics such as "MYbank Intelligent Guidance Design" and "Rural Financial Trust Design", and participated in the compilation and book publication of Class B experience design practice "U Point · Material - Alibaba's 1688UED Experience Design Practice Road".

Design concept: We hope to translate complex financial services through design and translation, better link customers, so that small and micro customers can understand and use well.

Multimodal Interactive "Design Lever" - Leveraging Digital Bank Revenue

In the field of traditional financial services, everyone is exploring how to introduce and build multi-modal interaction to make the experience of financial services better and the process of using financial services more simple and natural. With the rapid development of artificial intelligence, digital and intelligent technological means continue to help people improve convenience. The banking industry attaches more and more importance to online experience, and gathers many services online to create customer contact points such as mobile banking and online banking. However, the business of bank has its complex characteristics, leading to the service experience is not the best, so digital banks need to build a new experience model different from traditional banks.

Mybank is an Internet bank with no physical branches. Online banking services tens of millions of small and micro users, they generally lack financial knowledge, in the face of financial services generally do not understand, unable to operate and other problems. In the face of the above difficulties, the designers of online commercial bank upgraded a series of new design-driven digital banking experiences by reducing negative cognition and simplifying complexity, combined with new interaction methods.

Through this workshop, the presenter will share how to create a more intelligent experience design by combining the real situation of banking/financial experience design with multi-modal interaction.

This workshop will cover:

1、The main exploration direction of multi-modal design in digital banking

1.1 What is Multimode

1.2 Multi-modal design thinking model

1.3 Classification of multi-modes suitable for commercial scenarios

1.4 Development status of multi-mode technology, technology support to build new interactive experience

2、Multi-mode interaction value and design method

2.1 Design method: multi-mode design lever model

2.2 How to see - drive - technology deep integration

2.3 Design role position and independent value analysis

2.4 Mobilize multi-sensory channels to create active service connection

3、Multi-modal design applications and cases

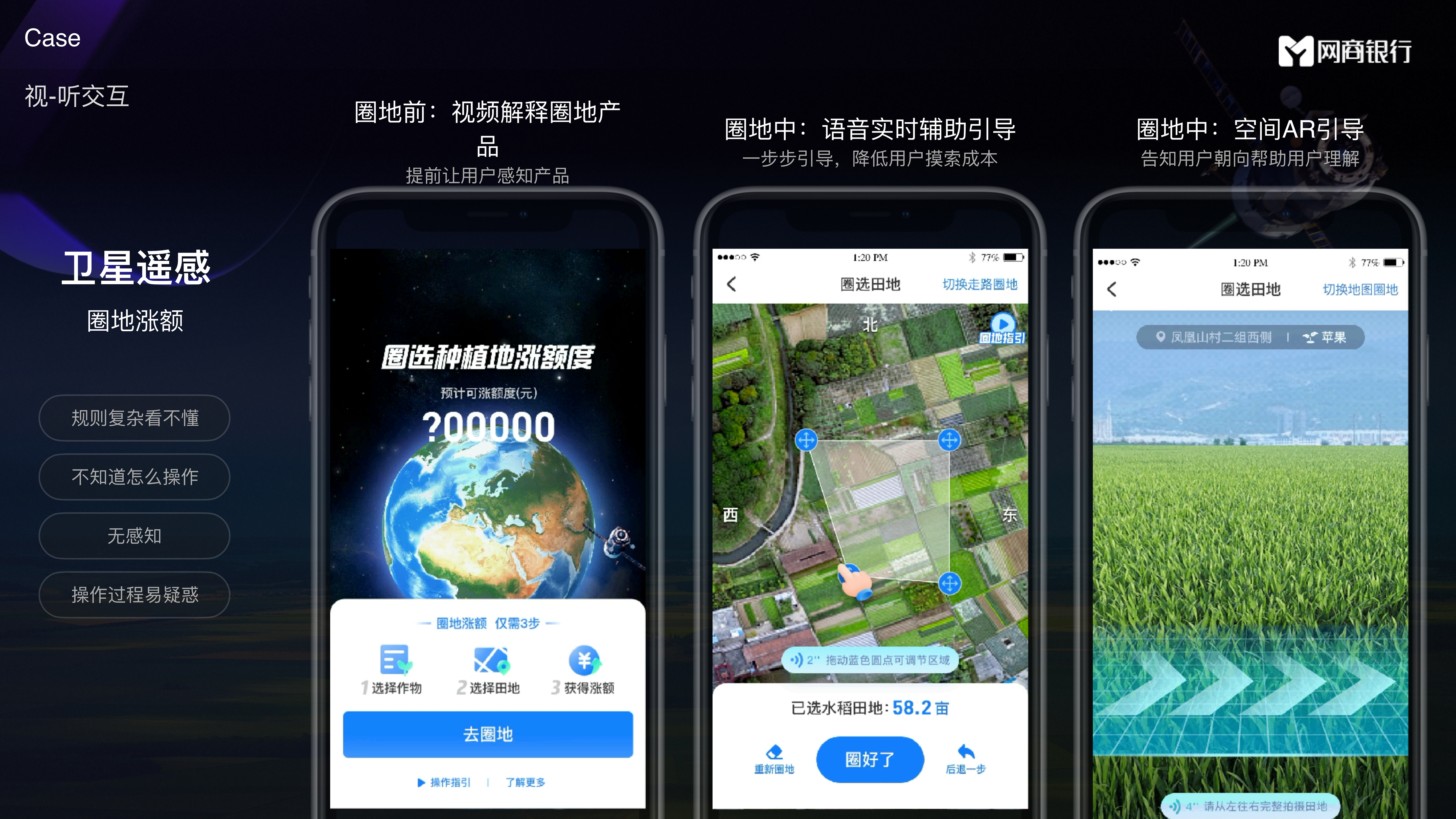

3.1 Digitalization of satellite image identification enclosure

3.2 In asset digitization, five senses design is combined with image recognition

3.3 Cross-end and jump-end strong hinders link design breakthrough

3.4 Explicit design independent value

4、Multi-mode design value stripping apparent

4.1 MVP verification mode based on AB experiment

·*MVP Pattern Definition

4.2 Expand the scale application of scenarios and calculate the value

5、Prospect of intelligent design in the field of digital banking

* Note:

·MVP mode: Minimum Viable Product, minimum viable analysis, i.e. minimum functional set verification mode

1、Summary of the topic background: Introduce yourself and the content

2、Explanation of concept: The concept and design method of multimodal design in banking industry

3、Case sharing: Take "Online Business Loan" as an example to explain how to apply multi-modes such as five senses in experience design

4、Practical interaction: Discuss in groups how to apply multimodal design such as Five senses in a project according to the customer, service and scene of banking industry

5、Open Question and Answer: Free exchange in the Q&A session

1、Mid to high level interaction designer

2、User experience designer

3、Visual designer

4、Banking/finance designer

5、Interested people in the AI industry

1、Understand the business logic and principles of Class B financial services

2、A new perspective on the financial services experience and users

3、Master the implementation process and methodology of multi-modal design lever

4、Discover the opportunities and challenges in intelligent design

-

Online commercial bank audio-visual touch interaction - space guidance

Online commercial bank audio-visual touch interaction - space guidance

-

Internet banking audio-visual interactive satellite remote sensing

Internet banking audio-visual interactive satellite remote sensing

-

Internet banking audio-visual interaction of various scenes

Internet banking audio-visual interaction of various scenes

-

The proportion of sensory channels in information interaction

The proportion of sensory channels in information interaction

-

Intelligent guidance design, improve the leverage efficiency

Intelligent guidance design, improve the leverage efficiency

-

Technology driven experience design strategy

Technology driven experience design strategy

-

Construct multi-mode interactive experience mode

Construct multi-mode interactive experience mode

-

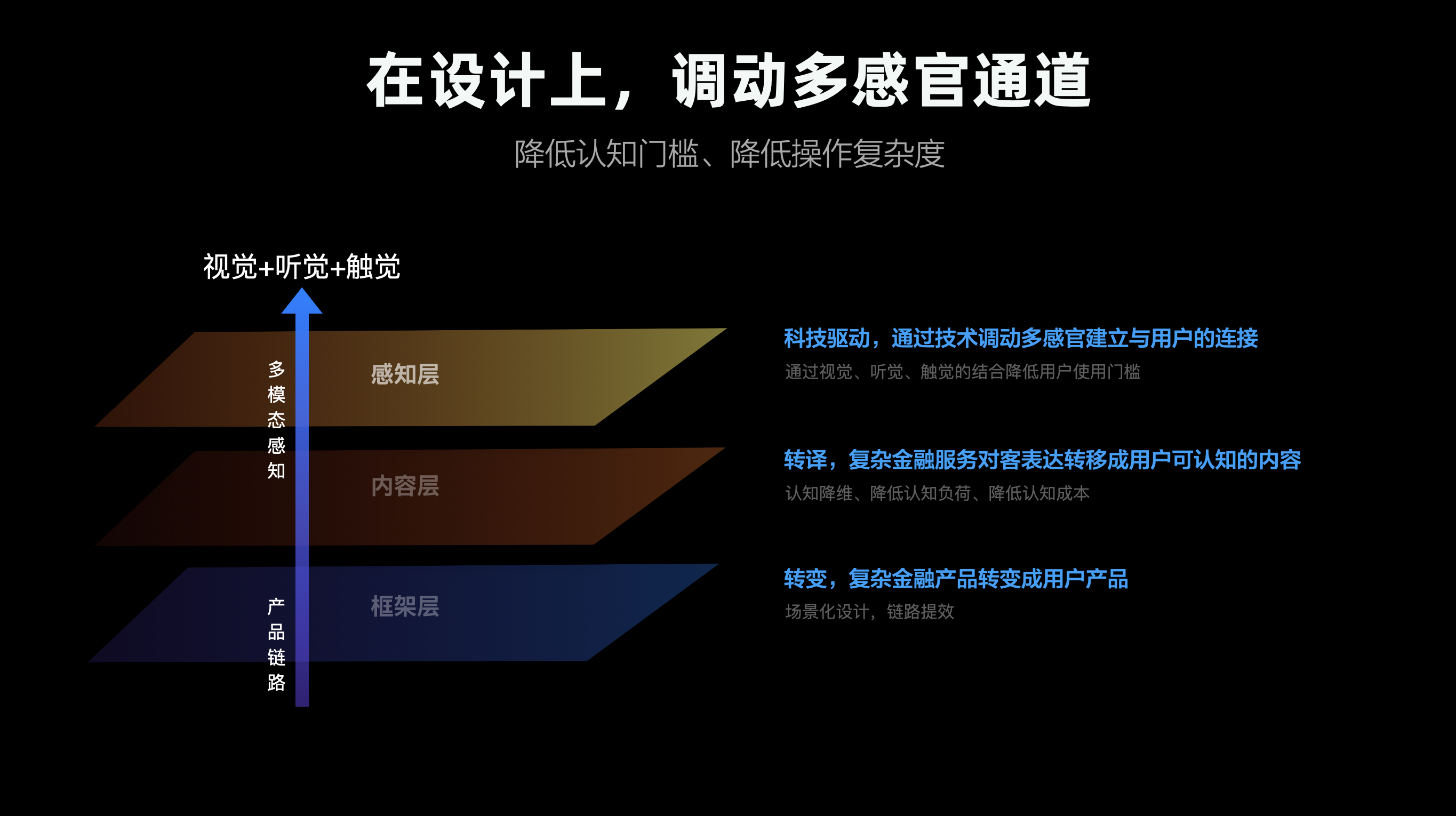

In design, sensory channels are mobilized

In design, sensory channels are mobilized