-

Yang Sensen

MYbank

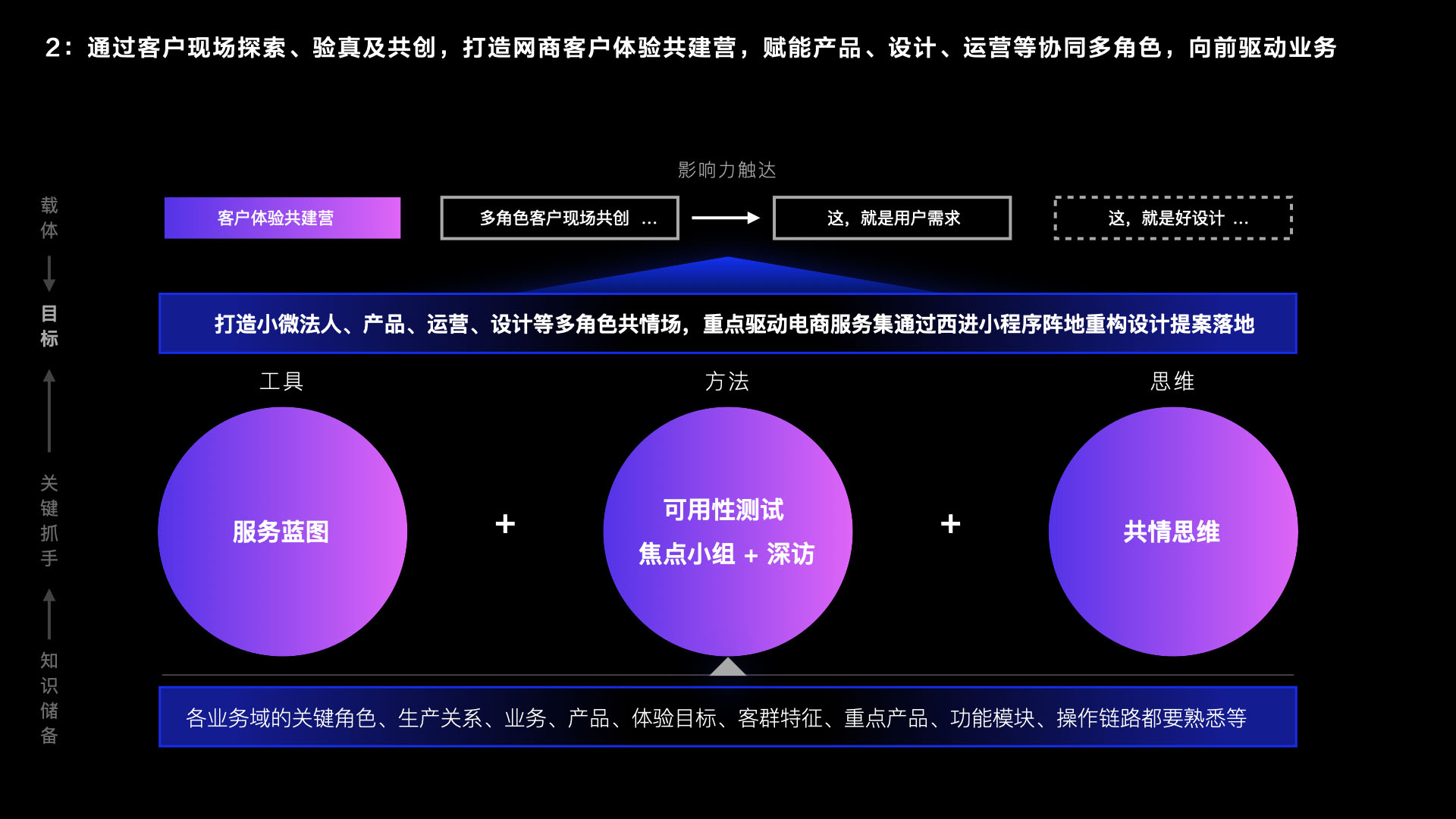

Experience Design Expert

Yang Sensen

MYbank

Experience Design Expert

Ant Financial Services Group has served for 12 years, involving payment settlement, content design, cloud computing Paas product design, comprehensive financial product design, etc., with rich experience in B-end product design and practical experience in user research.

Design philosophy: We always believe that people-oriented design centering on customer application scenarios and to-do tasks is the breakthrough of enterprise product design.

Customer Insight Models for Value-added Businesses that Focus on Problems to be Solved by Users

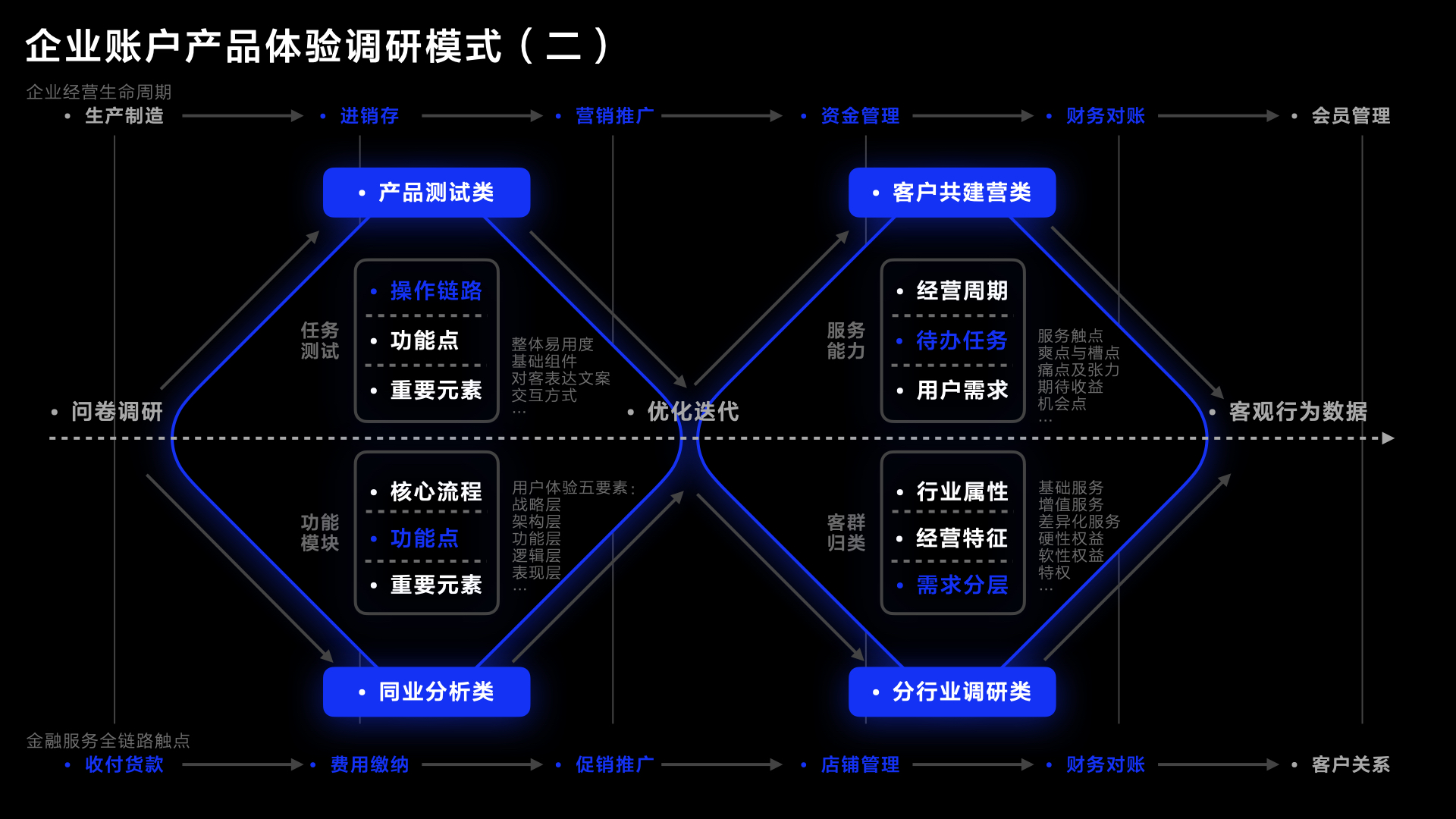

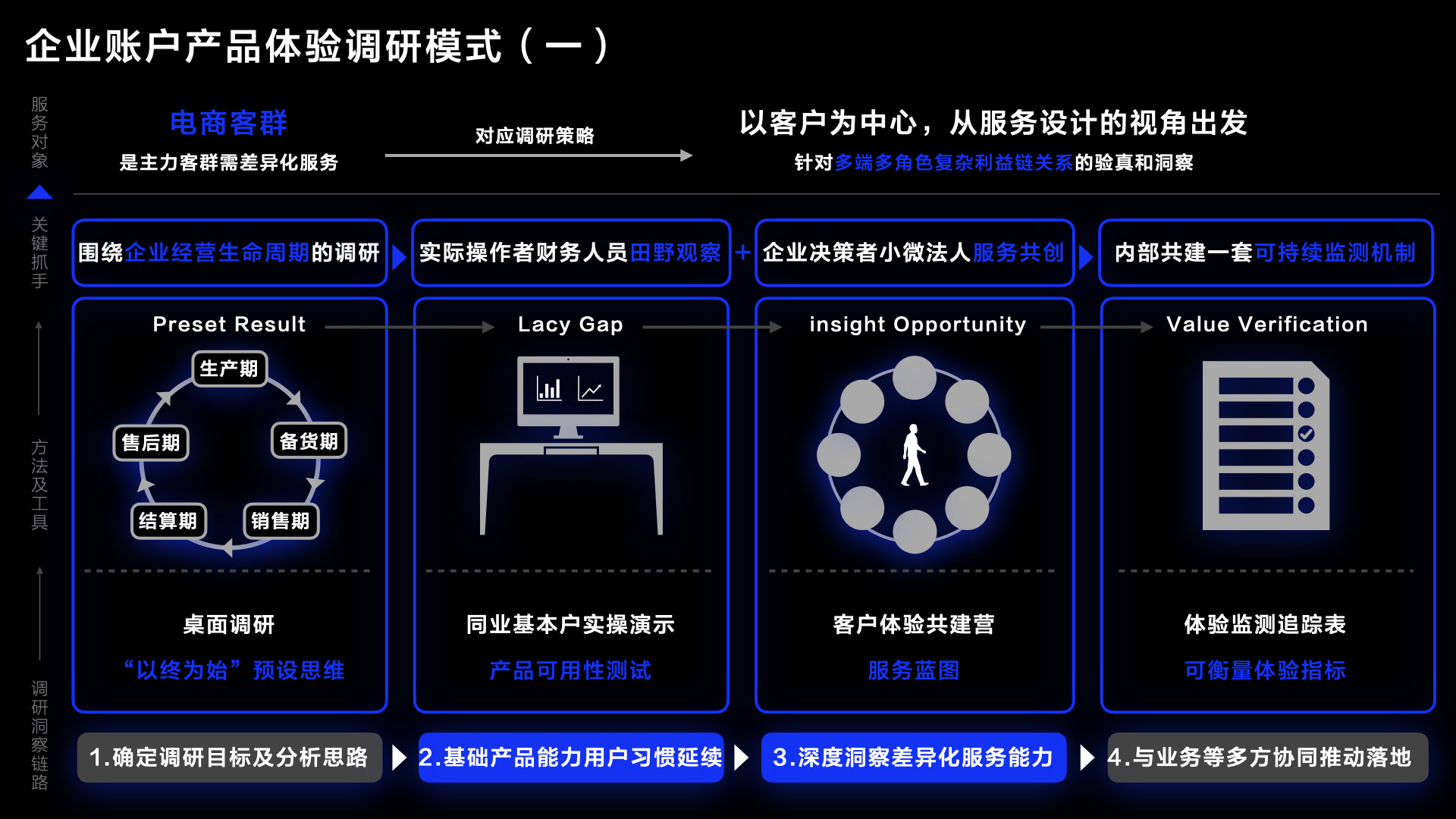

The traditional financial service concept of "where the money is" and "where the money is" is deeply rooted. Centering on the user research service content that can be provided in the whole life cycle of customer service, it is divided into the experience insight in the early stage, the insight in the process into the product design solution, and the experience monitoring and value measurement in the later stage.

We choose to start with customer experience insight from new businesses. This sharing focuses on the conception and practice of customer experience insight of enterprise product model in the financial scene.

The speech content of this workshop is as follows:

1. ToB business faces multiple customer roles and complex interest chain relationships. Managers are not decision makers, while actual operators are not decision makers, resulting in large information leakage

1.1 Relationship Graph - Sorting out the relationship of complex interest chain

2. In the financial scenario, the customers served by e-Bank are mainly small, medium and micro businesses, involving a large number of enterprise non-personal behavior decision-making scenarios such as financing and loans, deposits, financial management and account services. As the core KP, small and micro legal persons control the business direction and selected financial services

2.1 Characteristics and concerns of real controller

3. Take *JBTD as the starting point for on-site customer insight, combine the traditional research method focus group with the design method service blueprint, and connect the cognition of service providers and service users by creating a common field, track the implementation progress through experience monitoring, and deliver influence through experience operation touch

3.1 How Do I Apply JBTD on Customer Site

3.2 How to construct the empathy Field

3.3 How to experience monitoring and influence reach

* Comment

· JTBD refers to Jobs-To-Be-Done (JTBD) theory originated from Professor Clayton M. Christensen of Harvard Business School and was later applied by major Internet companies in Silicon Valley. The core of JBTD theory is to think about the problem the user needs to solve -- the user's purpose is not to buy your product or service, but to solve his problem. This theory can help product designers better understand user needs and provide more effective solutions for users.

1. Introduction of theme background

2. Explanation of theories and methods: Sharing of practical experience of JBTD's customer insight in Mybank's enterprise-class products

3. On-site propositional workshop, using insight methods such as focus groups and service blueprints

4. Interactive Q&A comments

5. Summary and review

1. Beginner/Intermediate experience Designer

2, 3-5 years of experience as product manager

3. User Researcher with 3-5 years of experience

4. Internet finance practitioners who are interested in customer insight

1. Learn how to get in close contact with customers

2. Know how to pull through and cooperate with the team to create

3. How to reach the manager's empathy

-

Insight conclusion synergies all parties to touch the ground

Insight conclusion synergies all parties to touch the ground

-

Multi-dimensional expression of design influence

Multi-dimensional expression of design influence

-

Explore the financial service appeal around the business life cycle

Explore the financial service appeal around the business life cycle

-

Customer - centered, from the perspective of service design

Customer - centered, from the perspective of service design