数智金融峰会

数智金融峰会

-

傅小贞

网商银行

企业金融设计负责人

傅小贞

网商银行

企业金融设计负责人

从手机系统、电商平台、理财平台到现在的银行设计,有多个行业大平台的从0-1的设计历经,现负责网商银行的理财与企业金融的设计工作,由之前To C的理财平台的设计转变为To B的小微金融服务体验平台,正逐步构建一套服务小微企业的体验架构体系。

-

高明

中国工商银行

用户体验负责人

高明

中国工商银行

用户体验负责人

现任中国工商银行业务研发中心用户体验部总经理,从事金融产品研发工作15年,拥有丰富的项目研发和用户体验设计团队管理经验,面向用户与基层,致力于打造人本、灵动、极致的产品体验,赋能金融产品项目研发及全行体验提升。

带领的用户体验设计团队,聚焦“感用户所感、超用户所期”专业愿景,在体系建设、方法论应用及体验创新方面处于业界前列,不断助力数字化转型下银行产品体验提升。

-

陈明

招商银行

体验设计团队主管

陈明

招商银行

体验设计团队主管

14年体验设计经验,7年以上的设计团队管理经验,擅长从0-1的组建团队同时也有对设计团队整合的能力经验。多年设计职场经验,涉猎方面广,提供全链路设计解决方案赋能业务,通过搭建设计体系保障业务的设计输出质量,沉淀高识别性的产品品牌基因,缩减设计和前端开发成本 还原设计的商业价值本质

-

赵永昌

海络梦想体验咨询

联合创始人

赵永昌

海络梦想体验咨询

联合创始人

从事用户体验行业14年。8年互联网体验设计与管理经验、6年企业客户体验咨询服务经验,先后服务于腾讯、字节跳动、中国银联、中国工商银行、中国建设银行、招商银行、民生银行、中信银行、兴业银行、北京银行、江苏银行、中国人保,为各个不同发展阶段的企业实现数字化转型下体验价策略,包括消费者洞察、用户体验、趋势研究等在多个领域研究与服务。尊重事实真相,利用溯因思维去探索和理解世界,为人们的生活提供新的价值与意义。

-

曲佳 度小满金融 用户体验中心负责人

度小满金融(原百度金融)设计总监,度小满金融用户体验中心负责人,原百度地图UX团队负责人,百度首席设计架构师,O2O产品体验设计专家。2010年搭建百度用户研究团队和百度用户体验实验室,2011年起专注于O2O互联网产品的体验设计和研究。2016年加入百度金融服务事业群,组建金融用户体验设计团队。

万物互联构建金融数智化

当下数字化经济蓬勃发展,从消费互联到产业互联,从物理世界到数字世界,金融行业的极致数字化时代已经到来。人工智能、云计算、物联网、大数据、区块链等技术与产业的深度融合,孕育出各种创新金融服务模式和全新的用户体验,金融行业的数字化转型正快速发展。在万物互联的智能生态下,更好的联结、更强的智能和更丰富的场景将是金融机构在数字时代构建竞争力的的关键。

另一方面,在日益复杂的世界环境,在全球应对气候变化挑战的背景下,绿色金融也成为金融业的重要发展方向。金融机构如何实现自身的绿色、可持续发展也是一项挑战。

本次数智金融峰会,我们邀请了多位金融机构的领跑者与专家,通过分享各自产品项目案例,与参会者剖析市场现状,探讨未来金融发展趋势,以共创共赢服务的视界探讨无处不在的金融体验设计该如何开展,以更好地激发服务产业,服务社会经济。

-

演讲一:《智慧科技创造银行新体验》

主讲人:傅小贞 ( 网商银行,企业金融设计负责人)

随着数字化、智能化的持续发展进步,银行业越来越重视线上体验,把线上服务作为重要的用户服务触点。但是服务的数字化与线上化不一定就是最佳的体验模式,数字银行需要走出一条不同于传统银行的新体验。

网商银行作为互联网银行,服务上千万的金融知识相对缺乏的小微用户,如何能更好地服务好他们,使得他们能获得服务及好的体验,让他们感受到“无微不至”。这需要通过服务的创新、技术的驱动、体验的再造,网商银行是如何融为一体地提供为我们的用户的?

一、认知解构降低用户的金融服务门槛。通过对用户的服务触达的信息解构,在场景中构筑触达-承接一体的认知模式,降低用户的认知门槛,提升用户对服务触达与认知。

二、科技驱动拓展金融的体验边界。通过各种技术的使用,推动银行交互创新,提升人们的金融服务体验。

三、主动交互技术构建线上服务体系。把原来线下和事后的银行服务体系变成用户在过程中的实时服务,通过主动交互的服务体系,提升用户的服务感知和质量。

作品/案例-

服务触点认知模型

服务触点认知模型

-

卫星遥感下的农业资产数据化设计

卫星遥感下的农业资产数据化设计

-

主动服务的在线唤起

主动服务的在线唤起

-

财富类产品的框架设计

财富类产品的框架设计

-

-

演讲二:《倾听用户声音,聚焦银行体验 ——以用户为中心的全流程用户体验提升方案》

主讲人:高明 ( 中国工商银行,用户体验负责人)

银行业是数字化发展的先行者,为实现高质量发展主动选择数字化转型。工商银行始终坚持数字化发展,率先迈入数字化2.0阶段,通过建设“数字工行”品牌,加快传统金融模式的数字化重构,深入推进数字化转型,着力提升用户体验、提升业务效率、提升经营价值。

本次峰会演讲基于工商银行业务研发全流程,围绕“用户”与“基层”,探讨用户体验工作实践如何在企业级、数字化的业务架构研发模式下与各环节有机结合,共同实现银行产品用户体验提升的探索与实践。

1、在金融行业用户体验背景下,阐释聚焦用户,工商银行用户体验工作是如何基于业务架构与业务研发各环节,寻找体验发力点的成果案例。

2、在赋能基层沟通效能提升上,讲述直达一线,工商银行是如何通过汇集基层声音,实现直达一线的信息高速,链接分行建设的具体实践。

作品/案例-

案例:打磨精品项目

案例:打磨精品项目

-

案例:工银兴农通“智”效提升

案例:工银兴农通“智”效提升

-

方法运用:用户研究方法

方法运用:用户研究方法

-

研发模式:与业务架构融合

研发模式:与业务架构融合

-

-

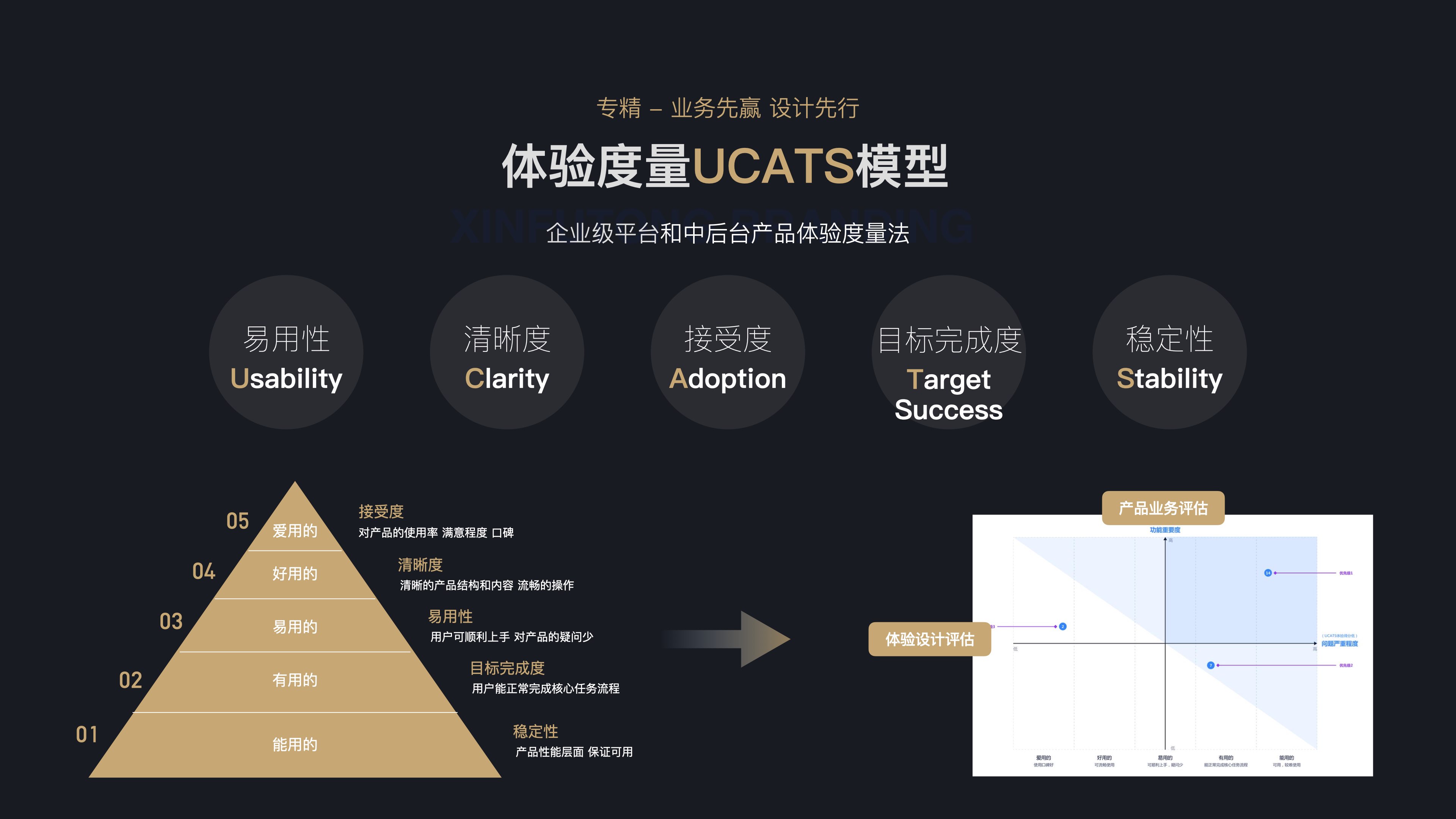

演讲三:《因您而变 设计先行》

主讲人:陈明 ( 招商银行,体验设计团队主管)

银行步入4.0时代,各商业银行纷纷将数字化转型纳入核心战略范畴,金融科技的日趋成熟,重塑了商业银行的业务经营模式。在一个越来越重视体验的经济体中,体验设计工作需要在新技术、新场景下,重新定义体验设计标准,打造金融领域商业环境下的优质用户体验,精细化设计管理赋能金融领域

打造金融专业级的设计体验,建立金融领域的体验设计体系:

1.业务支撑:业务先赢 设计先行,以用户视角做金融领域的体验表达

2.专业发展:设计转型全域设计能力

3.平台支撑:打造金融体验构建以“提效提质”的业务设计管理平台

4.组织文化:营造团队文化 建立跨团队、跨部门,专业分享、共建机制,打造高执行、懂商业、正能量的设计团队

作品/案例-

设计先行

设计先行

-

数字招行

数字招行

-

设计管理平台

设计管理平台

-

体验度量UCATS模型

体验度量UCATS模型

-

-

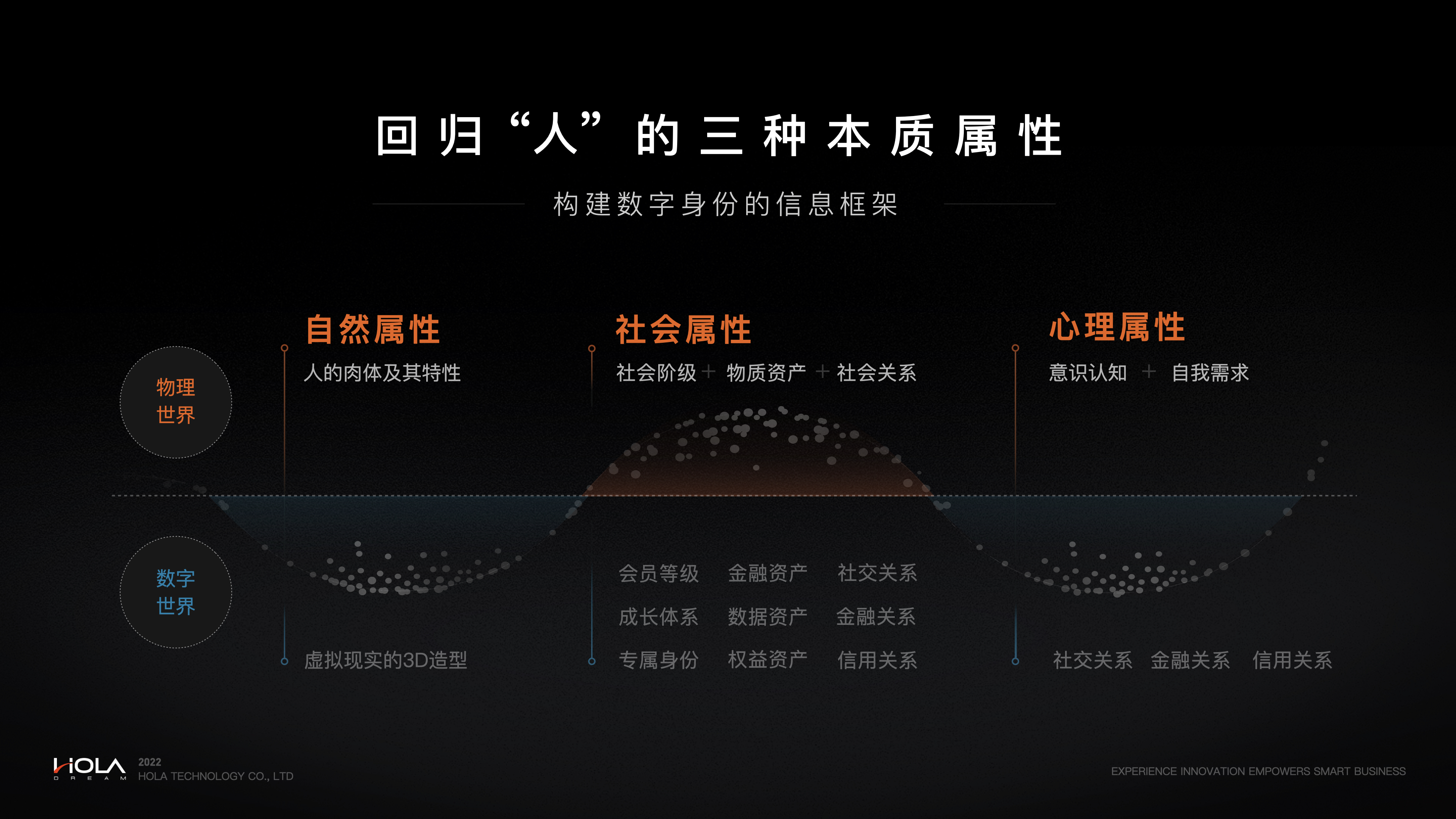

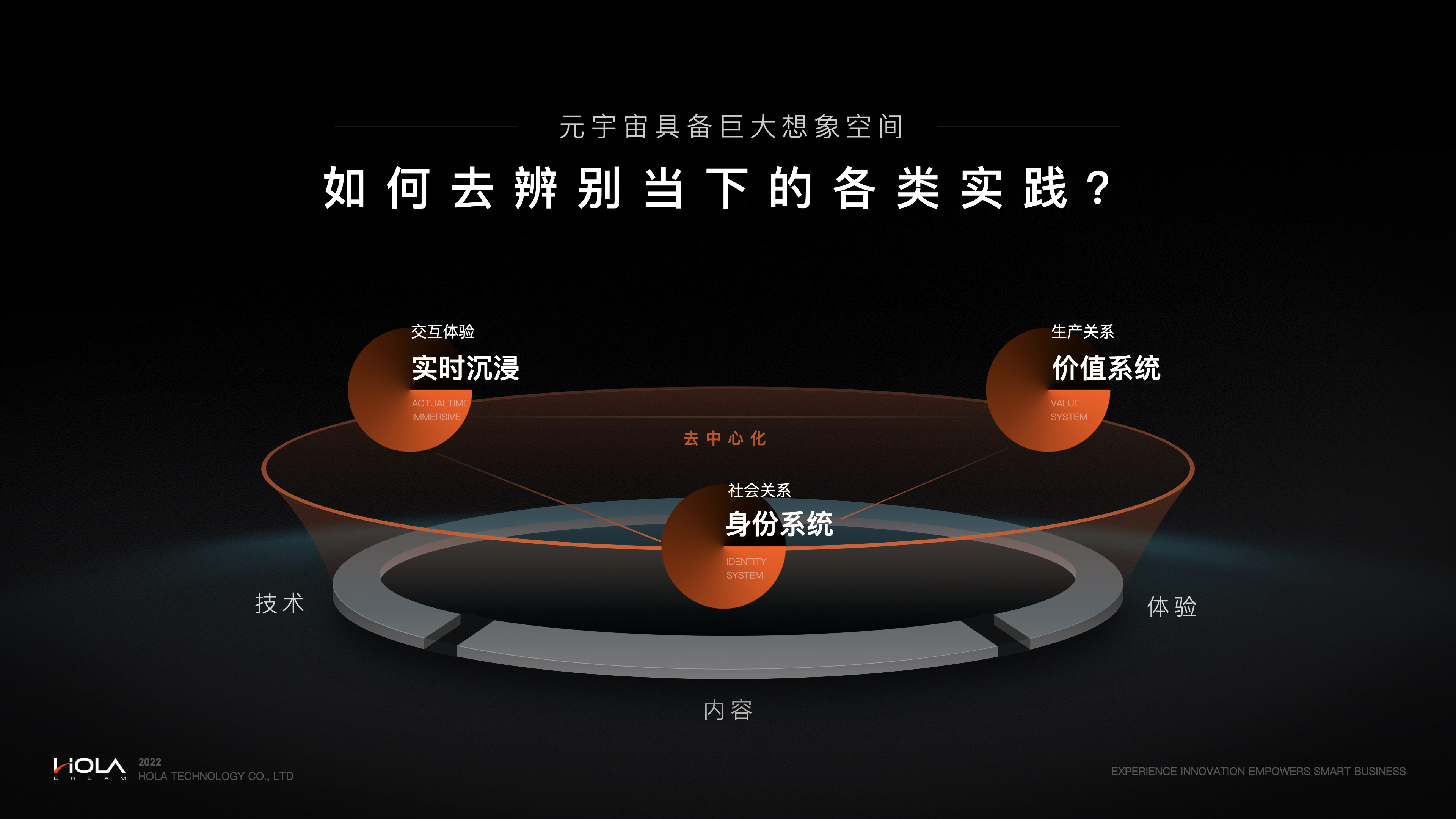

演讲四:《从银行数字化到元宇宙,体验驱动下的价值创新》

主讲人:赵永昌 ( 海络梦想体验咨询,联合创始人)

银行正在通过数字化的手段将原有的金融业务,以更多元、更智能的方式融入在用户的生活中以及企业经营的方方面面。而“体验”则是当下银行数字化转型的关键词,希望通过体验创新、金融科技的创新来重塑用户的数字服务旅程,从而提升自身的服务竞争力。在此同时,随着“元宇宙”这一概念的持续火热,又为银行数字化的发展开启了新的想象空间。在这场变革中,人类的想象力已从现实的限制下解放出来。技术在革新、思维在革新,但唯一不变的则是以人为本的核心战略观。

本次演讲将围绕银行数字化以及元宇宙这一题材,为大家分享我司与国内银行机构合作的创新实践。用深入浅出的方式,带您走进这个数字新世界。帮助您以体验视角,去认识元宇宙最朴素的底层逻辑以及金融数字的创新服务模式。更希望能通过分享我们的实践,来帮助体验从业者参与到这场数字经济的变革中,为虚实共生的数字世界创造价值,将我们擅长的能力得以变现。

具体内容包括:

1、数字化战略为传统银行带来商业模式上的变革

2、零售数字金融 - 围绕用户愿景,分层、分群式体验管理

3、企业数字金融 - 重塑服务关系,助力企业经营与管理

4、以体验视角解读元宇宙的底层逻辑及用户价值

5、实践分享- 通过体验思维重构银行用户的“数字身份”

作品/案例-

引入游戏化思维让数字身份流动起来

引入游戏化思维让数字身份流动起来

-

回归人的三种本质属性,构建数字身份

回归人的三种本质属性,构建数字身份

-

映射的核心关键“数字身份”

映射的核心关键“数字身份”

-

如何去辨别当下的各类元宇宙实践?

如何去辨别当下的各类元宇宙实践?

-

1、金融行业从业者

2、用户体验设计管理者

3、用户体验设计师

1、了解金融产品体验设计在数字化转型背景下的新变化

2、了解各类金融产品用户体验设计方法

3、了解金融发展趋势